In spite of the media and advertising portraying couples happily retired, not everyone wants or can afford to retire. In fact, there are numerous reasons why retiring at the same time might not be the best idea.

Reasons why you shouldn't retire when your spouse does include:

If you’re not the same age and you both are in good health, it might make more sense for one person to retire earlier than the other. This could be beneficial to, not only, your financial situation but your relationship as well.

Having said that, there are also reasons for why should spouses retire together.

You Have a Fulfilling Career

Certain people absolutely love what they do and shudder at the thought of giving it up. Their work provides great fulfillment and satisfaction.

This may be based on the people they work with, helping clients, the sense of challenge, and/or making a difference.

Some examples could include:

Why you shouldn’t retire when your spouse does is these folks aren’t ready. Feelings of resentment and loss could surface if they're forced to give up their career.

In most instances, they’re okay with their spouse retiring as long as they can continue to do what they love.

You're Not Financially Prepared

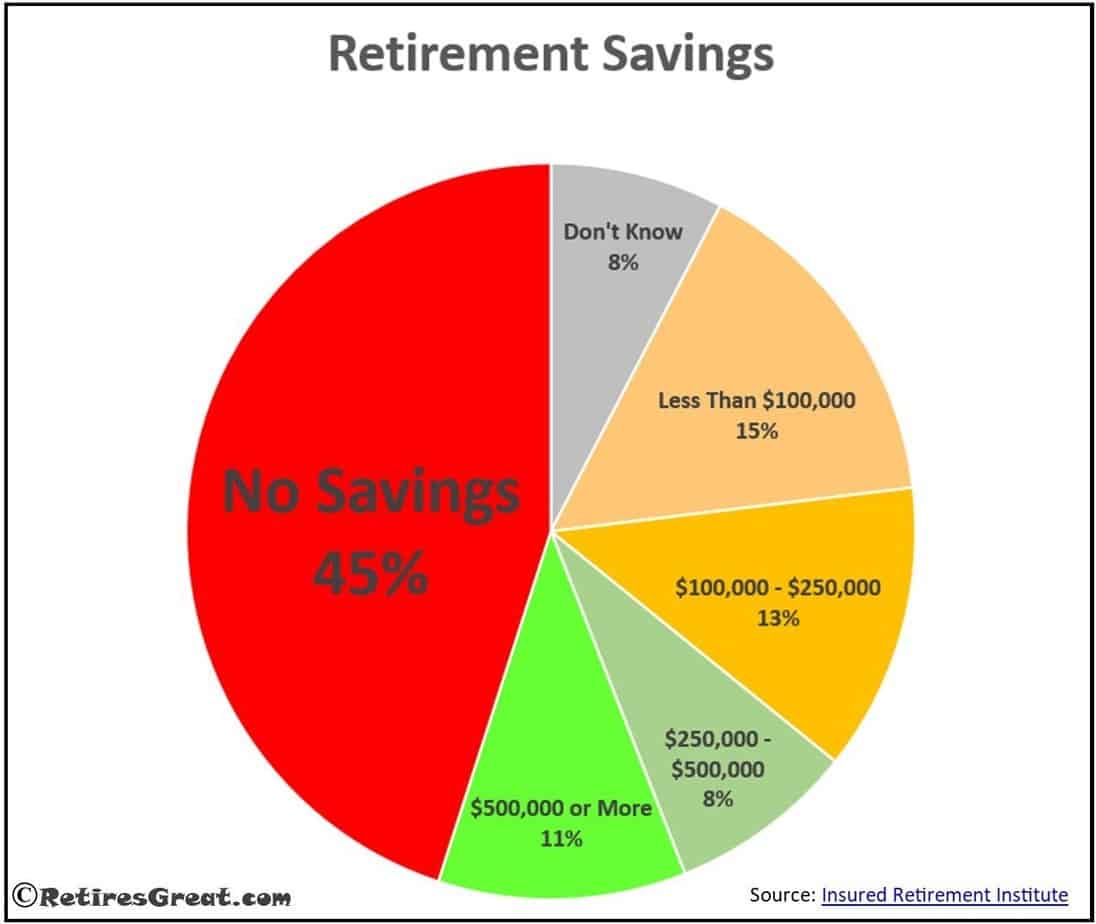

While it’s true we should save for retirement during our working years, almost three quarters of Americans have insufficient retirement savings. In fact, shockingly, 45% have saved nothing!

The switch from company run pension plans to self-managed 401Ks has been a hurdle that many haven’t been able to jump. Without a financial background, it can be almost overwhelming.

Options are not explained properly, you’re not sure where to go to get the best help or it’s just too confusing and you give up.

You may have had children that you wanted to put through college/university. Or, they had to move back home because of financial troubles.

Again, this impacts the ability to save for the day when you’re ready to retire. The stark reality of why you shouldn't retire when your spouse does is you can’t afford to stop working. At least, not yet.

Related Article: Baby Boomer Facts: The Truth About the Retirement Crisis

What Will Retirement Cost You?

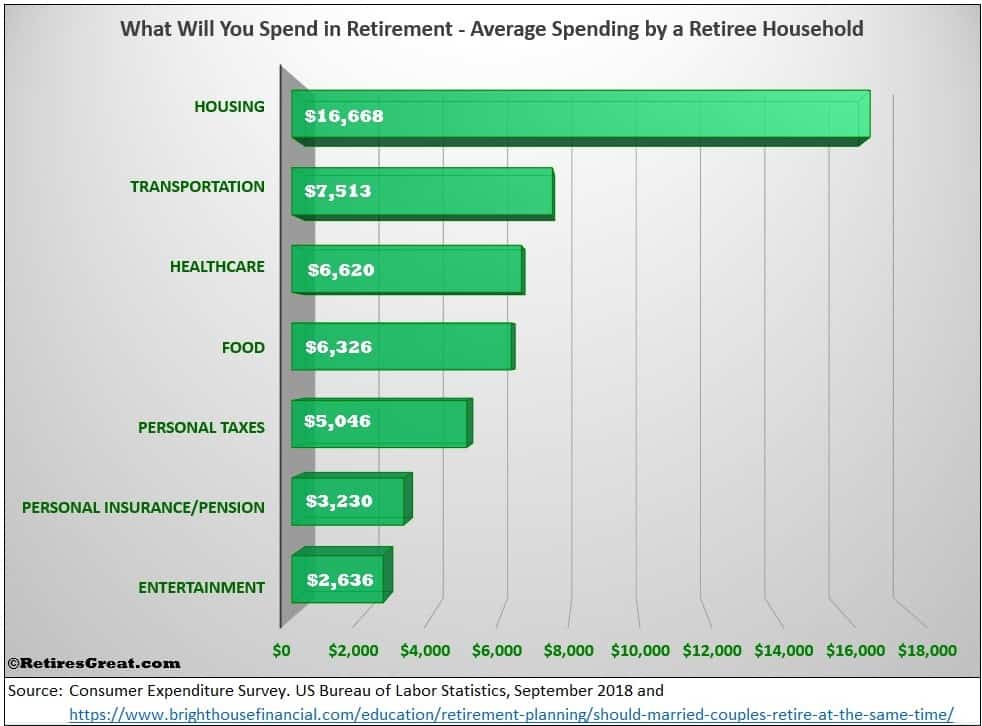

The cost will be dependent upon you and the lifestyle you desire in retirement.

While some expenses will go down - like commuting and clothing – others will increase. For sure, you'll spend more on healthcare.

Then there are the discretionary costs or “fun money”. Pretty much everything we do winds up costing money. Any hobbies, dining out with friends, seeing a movie or play, and any travel plans will quickly add up.

The biggest difference, now you have lots more time to do things. Surviving on a miserly budget isn’t much fun. This is why you want to budget for this extra spending and enjoy your retirement.

When you retire, you no longer have an income to supplement your savings. It might make sense to stagger your retirement dates so you continue to build your investments.

Also, you're delaying the number of years that your assets have to pay your expenses, making them last longer.

Related Article: How to Write a Retirement Plan

Healthcare and Social Security Benefits

As is often the case, spouses are different ages. Traditionally, on average, the man has been 2.3 years older than the woman.

This may impact the timing for social security and health insurance coverage. This is why you shouldn't retire when your spouse does.

When you turn 65, you’re covered by the basic Medicare plan, Parts A & B. While Part A is free for most Americans (based on eligibility), Part B is not. In fact, your monthly premium is determined by your income.

Also, the future of social security is in a precarious position. Already underfunded, this raises major concerns for those who'll be dependent upon it. In short, without an income you may find yourselves living in poverty.

Social Security

Benefits are dependent on what age you decide to start claiming social security as well as what your earnings history has been.

You may want to retire and claim social security at the youngest age of 62. As you're starting at the earliest age, your benefits will be reduced.

Maybe one of you wants to wait until the full retirement age of 66/67 to get the entire supplement.

Especially if you missed out on earnings during your peak years, you might wish to stay in the work force a while longer to increase your social security amount when you're ready to claim.

The benefit is if one of you retires later than the other, social security will continue to increase and grow. This ensures that, as a couple, you're getting the maximum social security to supplement your retirement income.

Healthcare Insurance

Healthcare is one of the biggest expenses in retirement. It’s another reason why you shouldn’t retire when your spouse does.

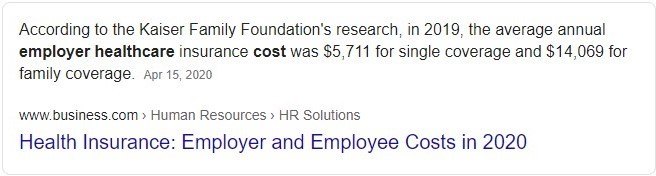

If you retire prior to age 65 (Medicare eligible), health insurance can be a significant cost. Most employers offer generous benefit packages shielding you from the full cost.

When there’s an age difference, the younger spouse may continue working until Medicare kicks in.

The advantage is they’ll still be covered through employee benefits reducing their costs. Some even have provisions where the retiree could get added onto their program further reducing the costs.

On the flip side, the older partner might have a better plan and coverage through their employer. He/she may continue working until the younger one reaches the Medicare eligibility age of 65 to ensure coverage.

This would, also, keep the expenses down.

Related Article: 7 Ways to Reduce Healthcare Costs in Retirement

Are You Ready to Spend a Lot More Time Together?

Retirement can be a huge transition. Some will make it easily while others will struggle with loss of identity, social interaction or boredom.

When you retire at the same time, all of a sudden, you’re together every single minute of the day!

That can be quite a shock to the relationship and why you shouldn't retire when your spouse does. You may experience exasperation or irritation.

Having the separation of work gives you some boundaries in your relationship. Overall, it might be easier if one retires first. The one who retired gets used to time alone and can figure out who they are now as well as a new schedule for their days.

During this initial adjustment, there’s still the separation of work so it’s not so much of an “all or nothing” situation. For now, the boundaries are still there.

If you retire together, you’re both going through this transition at the same time. There could be frustrations or anxieties that build up.

And who are you most likely to take it out on? Each other because you’re together 24/7.

Do You Agree on What Retirement Will Look Like?

As long as the finances are in order, a lot of couples’ wonder “why worry, I’m just retiring and it’ll all be fine”. That’s sort of like going skydiving for the first time and trusting all you need is a parachute.

Have you and your spouse taken the time to discuss your expectations and desires once you retire? Discussions on where to live, what to do to fill your time and how are you going to get along/adapt all need to happen.

Most of us are caught up in the day-to-day activities of living and what your spouse wants, often, gets overlooked. Patience, understanding and listening to each other are key.

Related article: Complete Guide to Improving Your Marriage in Retirement

Closing Thoughts on Why You Shouldn't Retire When Your Spouse Does

The reasons for why you shouldn’t retire when your spouse does are both financial and emotional.

By staggering or delaying your retirements, you give yourselves the time you need to adjust and make your golden years as successful as you can.

Financially, it means you’re drawing down your assets slower and minimizing healthcare costs.

Emotionally, you have the space needed to find your own path without being in each other’s faces all day and night. This can reduce strain and make you stronger as a couple.

Retirement is the evolution into a new phase of life – hopefully, the best and greatest years are yet to come.

Related post: Retirement Proof Your Relationship