You’ve probably heard that we’re heading into a retirement crisis. The reality is our world has significantly changed and our retirements will be vastly different than our parents were. Some of the following facts about baby boomers may surprise you and, hopefully create some insight into your own retirement.

As a generation, baby boomers experienced more societal change and cultural upheaval than any other previous generation.

We can be proud of momentous events such as putting a man on the moon, civil rights and medical break-throughs such as ending small-pox and polio. Other major changes include the birth of rock and roll music, the World Wide Web (www), and social media.

Traditionally, retirement started at age 65, characterized by a life of leisure for one’s remaining years. This has dramatically changed with increased life expectancy, better health and the desire to live a more active life.

Massive numbers of baby boomers are retiring each and every day and will continue to do so for the next decade. Sadly, many don’t have the financial means to support themselves for the next 20 to 30 years.

Let’s look deeper into the facts about baby boomers and the impending retirement crisis.

1. Unprecented Number of Baby Boomers Retiring

There are approximately 70 million baby boomers throughout America, making up approximately 28% of the population. According to the U.S. Department of Health & Human Services, “more than 10,000 people turn 65 every day in the US and people are living longer, healthier lives.” This trend will continue until 2030.

There are multiple ramifications to having such a top-heavy aging population and workforce, which will deeply impact each and every one of us. All their knowledge, experience and strong work ethic are walking out the door in droves. Younger generations will take on new roles and responsibilities because of these vacancies.

As well, Social Security is already strained with ongoing reform discussions. Retirement and extended care facilities are at or near capacity and the risk of being overwhelmed in the near future is real. Healthcare costs continue to increase at alarming rates.

2. Baby Boomers Have Inadequate or No Retirement Savings

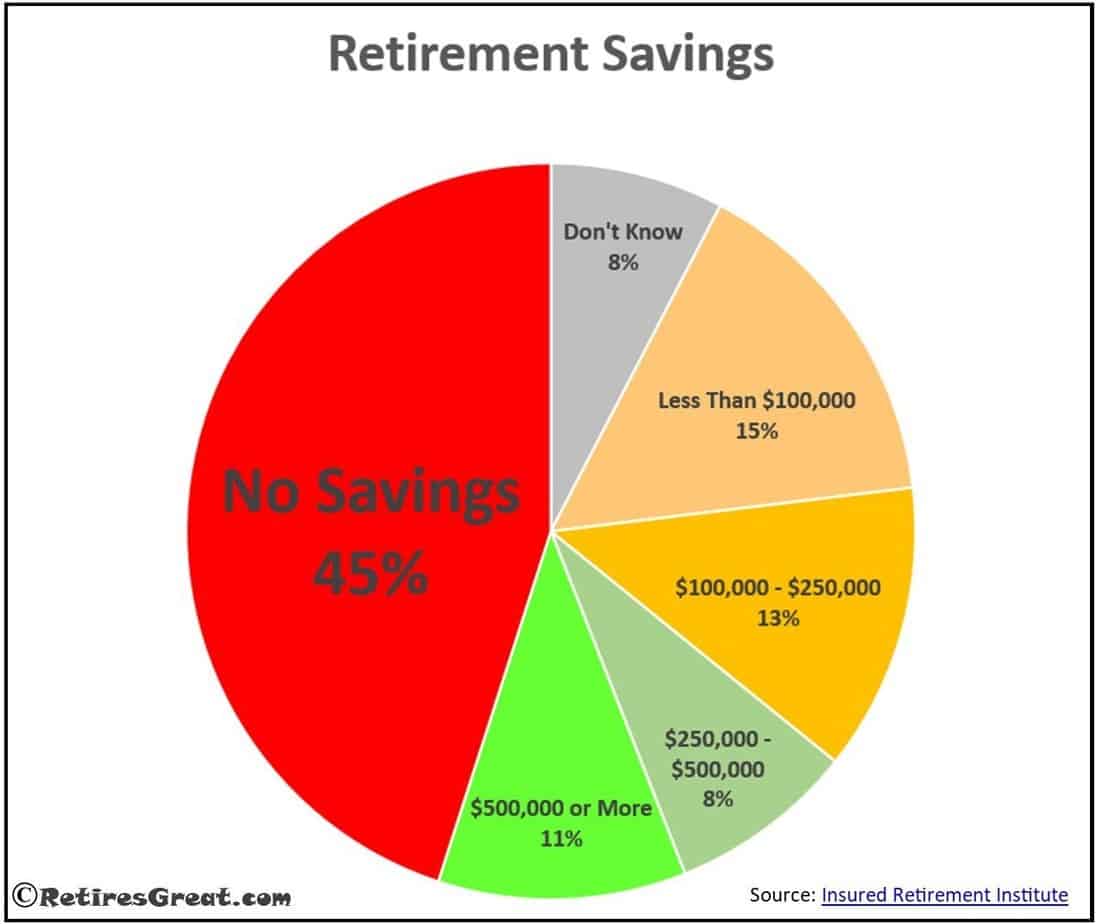

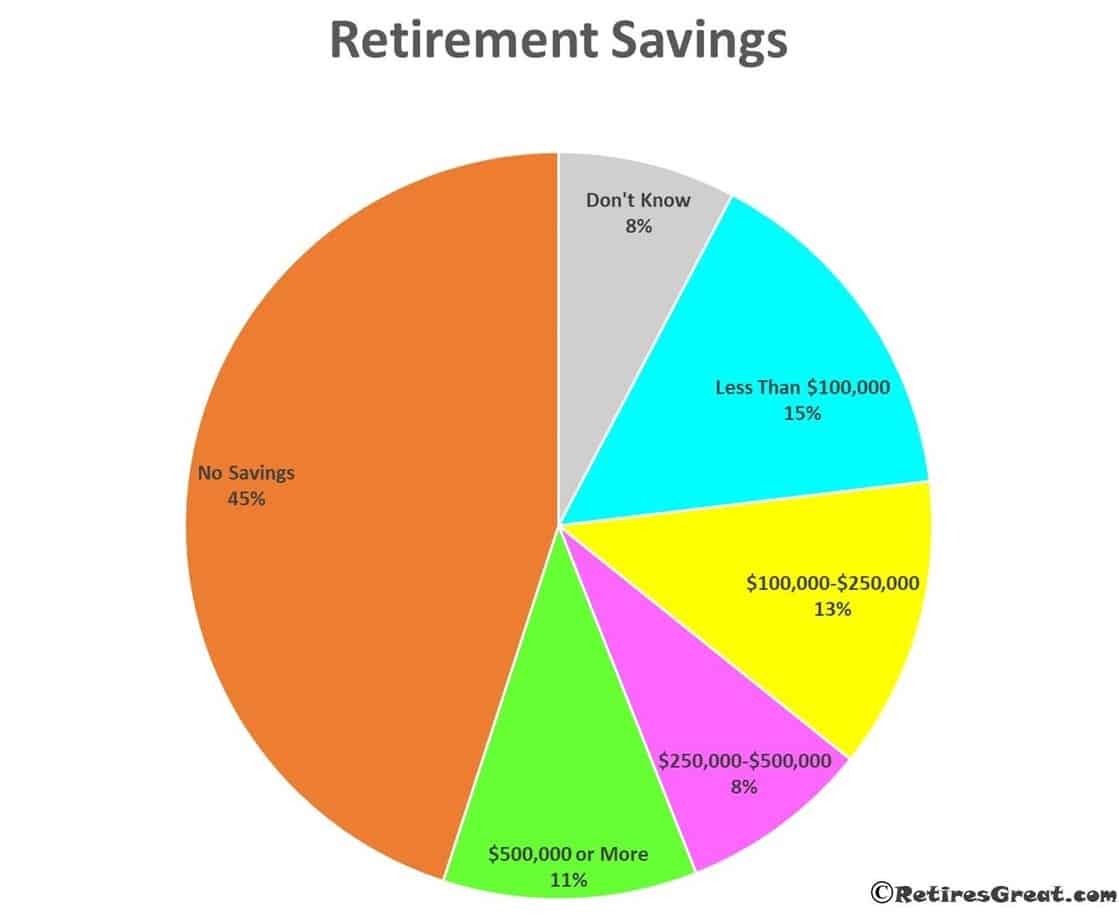

We all know we should’ve saved money for retirement during our working years. A recent survey from Insured Retirement Institute revealed 45% of Americans have no savings at all. Of the 55% with retirement savings, over half report less than $250,000.

Thus, approximately three quarters of all retirees have none or inadequate savings and will be fully dependent on Social Security. Although it seems incredible, there are numerous contributing factors.

Lack of Financial Savvy

Over the past couple of decades, we’ve seen a shift from company pension plans to self-administrated employee plans.

The real benefit of a pension was everything’s managed for you with automatic deductions. If you changed employers, often the pension plan no longer existed and you became wholly responsible for a self-administered plan.

Most companies partner with a financial organization and offer their employees matching contributions. Options aren’t always explained in a manner which would help employees make sound financial decisions.

The onus is upon them to read the literature, make sense of it and determine their best investment strategy. Without an understanding of the significance of participating, as many as one in four employees miss out on the matching company contributions.

Relative to the market, the average investor consistently earns below average returns. According to Cymbria, between 1991 and 2021, the average equity fund investor earned 7.1% whereas the S&P 500 Index averaged 10.7% (a discrepancy of 3.6%).

For those few with an aptitude for finance, they took a more active interest in their investment strategy and developed a more balanced portfolio.

They educated themselves on the concepts of compound growth, diversified portfolios and risk tolerance. Over their working life, they diligently saved money and monitored their investments. This led to better financial security for their retirement.

Other Contributing Factors:

3. Baby Boomers Are Working Longer

Even though the trend is toward earlier retirement, 31% of baby boomers state they plan to retire at 70 or not at all. The Insured Retirement Institute notes that only 7% of all retirees actually retired after the age of 70.

What we do observe is 65% of retirees re-enter the work force either on a part-time or volunteer basis either for financial reasons or just to remain active.

4. Increased Life Expectancy

Back in the 1950s, the standard retirement age was 65 with an average life expectancy of 67 years. The national average has risen largely due to healthier lifestyles and improved health care. According to data compiled by Social Security Administration [US]:

Although these are averages, additional factors need to be considered on an individual basis such as current health, family history and lifestyle.

5. Social Security Concerns

The scariest of the facts about baby boomers is the future of Social Security is in question and concerning as so many retirees will become dependent upon it. Our article, The Future of Social Security, offers more insights.

According to the Social Security Administration, “as a result of changes to Social Security enacted in 1983, benefits are now expected to be payable in full on a timely basis until 2037, when the trust fund reserves are projected to become exhausted. At the point where the reserves are used up, continuing taxes are expected to be enough to pay 76 percent of scheduled benefits”.

It’s highly probable we’ll see reform prior to 2037 which may include increases in payroll tax, decreased benefits or some combination of both. The fundamental issue is birth rates have declined resulting in lower overall contributions with an increase in the numbers of retirees drawing upon it.

6. Sky Rocketing Healthcare

Healthcare costs could easily become the greatest cost in retirement making it one of the most concerning facts about baby boomers.

The Insured Retirement Institute state “in their lifetime, an average healthy 65-year-old couple retiring in 2018 could expect to pay $363,946.00 in Medicare, supplemental insurance premiums and out-of-pocket costs; and this doesn’t include the cost of long-term care.”

Genworth cost of care research indicates 7 out of 10 people will require long-term care in their lifetime. The national average cost for assisted living is $4,000.00 per month whereas a nursing home (semi-private room) is $7,441.00 per month.

Of growing concern is the increase in Alzheimer's and other forms of dementia. Affecting an estimated 5.8 million Americans, this number will only continue to increase as our population ages.

According to Bankrate, if you or a loved one are diagnosed, it becomes imperative to get your affairs in order and manage your finances. Our post, Living Will, delves into an enduring power of attorney, living will, etc.

This is particularly important due to the progressive nature of the disease as well as limited assistance from Medicare and other healthcare plans.

Closing Thoughts on Facts About Baby Boomers

All these facts reflect on the baby boomer generation and their overall influence. As they retire, there’ll be shifts in consumer spending patterns, housing demands, healthcare services and a demographic switch in the work force.

They’re living longer and, now, have the opportunity to explore new hobbies, travel or spend more time with their families. Medical needs and healthcare coverage become critical as they age.

The new retirement landscape is one few have prepared for. Change is inevitable. How we choose to adapt and adjust will determine the quality of each of our lives after retiring.

Hi Debbie & Shannon! This info is so important for all of us to know about–and even if we’ve heard it before it bears repeating because it will effect all of us. Like you say, having financial savvy is critical. But although “change is inevitable.” I so agree that “How we choose to adapt and adjust will determine the quality of each of our lives after retiring.” ~Kathy

Thanks, Kathy! Very well stated, there’s many interesting aspects into our generation of baby boomers. Certainly, financial savvy or lack thereof can affect the quality of life in retirement. If nothing else, changing and adapting is critical.

Debbie & Shannon