Purchasing a vehicle ahead of retiring seems to be a common practice. Pay for it while you still have a paycheck and have a reliable vehicle in the years to come. But, should you buy a new car before retirement?

Back in 2012, I was in dire need of transportation. The head gasket on my high mileage Mazda Protégé let loose frying my engine.

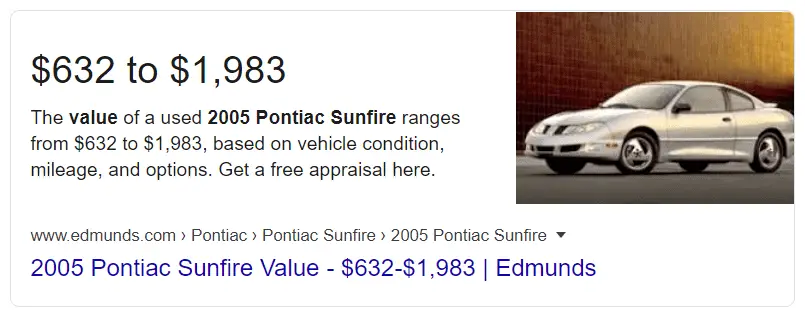

It wasn’t worth repairing. Scouring the “for sale” ads, I found a 2005 Pontiac Sunfire for a reasonable price. Keep reading and learn how this one turned out for me!

The interesting part was the fellow selling it was within weeks of retiring. He wanted something modern taking advantage of 0% financing.

Reasons to Purchase a New Vehicle

There are numerous reasons why it could make sense. At the heart of the matter is pride of ownership. Owning something you can be proud of and is exactly what you want.

With historical all-time low interest rates, financing is easier than ever! In addition, this pandemic means the dealerships are hungry for business. In short, you might get the best deal ever! Now might be the time.

Further to this, there are many additional benefits, such as:

It’s your money to spend as you wish and if a upgraded car/SUV/truck provides satisfaction, why not? From that perspective, it might be your last big purchase. And, you deserve the reward after all those years of hard work, right?

Paying For It While Still Working

We all know income and debt ratios become critical in gaining finance approval. Therefore, you have a better chance while you’re still working.

The last thing any of us should is do tap into our hard-earned savings and incur the associated penalties of early withdrawal.

Another part of preparing to retire is getting any debt and big expenses out of the way. I observed this with several of my friends. For example, one desired to winter in Arizona.

Besides the 34-foot 5th wheel trailer (with slide-outs), he needed the truck to pull it. All together, it probably came to $150,000. To pay for it all, he chose to work more several years to “live the dream”.

The Amazing Deals

Make no mistake, auto makers have the marketing of automobiles down to a fine art. They heavily promote:

According to their marketing departments, we’d all be fools not purchase one because they are going to run out!

Everything’s expressed in easy monthly payments. If you want to reduce your monthly cost, no problem, they can just extend your financing by a few more years.

Peace of Mind with Years of Trouble-Free Operation

Unlike a used automobile, if anything goes wrong it's covered under warranty. There’s peace of mind knowing you’re not going to be nickel and dimed to death with repairs. Or even worse, hit with a major expense such as a transmission failure.

This translates to years of trouble-free driving rather than financing your mechanics three children’s college education. And, it’s not like an investment you’ll get your money back from.

In some cases, maintaining an older vehicle can cost more than purchasing a better one. Not even to mention the inconvenience of dropping your vehicle off at the shop.

Potential Business Expense

Hey, when you buy a new car before retirement, you could claim it as a business expense. Or even just the mileage and out-of-pocket- costs can be greatly reduced. In some situations, the tax implications alone justify driving a current year model.

Perhaps you’re thinking about becoming an “Uber” or “Lyft” driver to make a little extra income. I assume you’d be able to expense some portion of your expenses.

In some situations, you’d penalize yourself limping along with an older vehicle. As an example, if a real estate agent picked you up in a crappy old beater, you’re not going to feel reassured they’re all that successful!

Improved Credit Rating

It’s no secret one of the fastest ways to improve your credit rating is to finance a vehicle. It's almost like “killing two birds with one stone”. Not only is your credit score bolstered, you also get the vehicle you always wanted.

Case Study One: Debbie's Jeep Compass

First off, Debbie absolutely loves her 2015 Jeep Compass. Everything she ever wanted in a vehicle and truly has become her “baby”. When I asked what she most likes about it, her response included:

Back in 2015, Debbie decided to traded in her one-year-old Dodge Journey for the vehicle of her dreams. I know, the worst financial decision she’s ever made.

I’m sure they rolled over a bunch of finance charges and built them into her Jeep payments. Since, she’s been paying just over $500 a month.

All this was a non issue while she was working. After 4 years, her $30,000 Compass has depreciated to $15,700. Now, at the end of the 5th year, the value is closer to $14,000.

We still have two more years of payments.

Of course, every couple of months a salesperson call extolling the fantastic deals they can offer her on Grand Cherokee! They can even keep the same monthly cost.

What Did it Really Cost?

Excluding regular maintenance (as I’ve done all the oil and filter changes), our operational costs have been reasonable:

Other than these costs, her “baby” has purred like a kitten. If we factor in the depreciation over the past five years with these expenses, the yearly cost has been $3,520.00.

Purchasing a Vehicle is the Worst Investment Imaginable

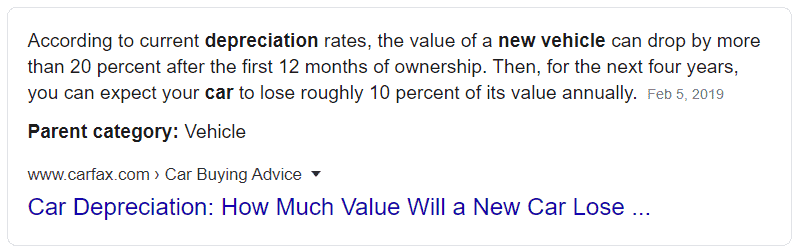

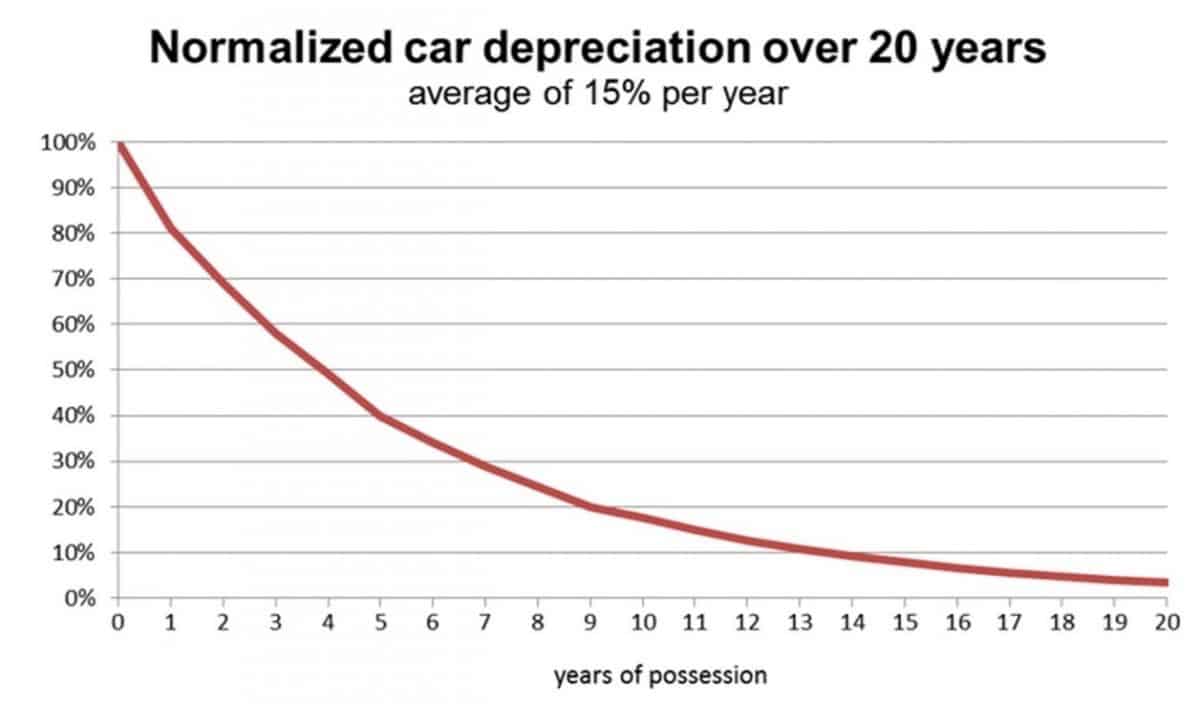

Although we may want to buy a new car before retirement, you should understand this is one of the worst investments imaginable! The minute you drive it off the dealership lot, on average, you have already lost 10% of its original value.

For Debbie, the drive home in her Jeep Compass cost her $3,000.00! By the end of the first year, she had lost about $6,000.00 - 20% of the value. Sad isn't it?

After five years, it’s cost us about $16,000 in depreciation. Imagine if we could have invested that money into a 401K? There’s no point in crying over spilt milk and as I mentioned, she loves her Jeep and it is very, very reliable.

By João Pimentel Ferreira - Own work, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=28428767

Case Study Two: Shannon's Sunfire

Did I mention I still own my 2005 Pontiac Sunfire?

In my opinion, it’s a great little vehicle that still looks good and is fun to drive. I’m not saying you should get a Sunfire. In fact, probably not as they’re pretty basic. Mine has very few options. All the stuff I don’t have:

This suits me perfectly as there are less things to go wrong. The previous owner was an aircraft mechanic and kept it immaculate and running smoothly. After eight years and over 80,000 miles, it's been almost trouble-free.

What Did it Really Cost?

I purchased it in 2012 for $3,400.00. Gas mileage is about the same as the Jeep and insurance is less. Like the Jeep, the tires ($600.00) and the battery (under $100.00) needed replacing.

In addition, the muffler was trying to part ways and required replacing a bracket costing another $100.

Also, there was a spot of surface rust developing behind the rear wheel well. That required grinding off the bubbled paint and touching up with some silver paint.

It just so happens I have some on hand. Note to self, pick up the proper matching paint/check the paint code.

Assuming I sold my Sunfire, I’d expect to get around $1,200.00 for it. That means a total depreciation of $2,200.00. Adding up the other expenses, over eight years it has averaged $375 per year!

I’ve been fortunate and budgeted $400.00 a year for repairs. In the event of a catastrophic failure, I have funds for major repairs such as replacing an engine or transmission.

Likewise, this money could be used to upgrade to something more modern. Even accounting for this, the yearly cost remains under $1,000.00.

Closing Thoughts on Should You Buy a New Car Before Retirement?

So, should you take the plunge and buy it brand new? It really depends upon your needs and desires. In some situations, it may make sense.

You might need to upgrade to avoid all the trips to the repair shop and the ever-increasing costs. Not to mention the inconvenience!

Considering COVID-19 and interest rates, perhaps now is the best time to get that beautiful vehicle you always wanted. Then again, maybe purchasing something that is all shiny and modern isn't the best decision.

Is that wonderful smell and feeling worth all the extra money and debt? On the other hand, keeping your existing chariot or locating a “gently used” one can save you thousands of dollars.

You could have yours paid off or very close to it. By purchasing an older/used model you would be, in effect, saving the loss of your finances/savings. The depreciation has already been deducted making the price that much lower.

I agree with you, “considering COVID-19 and interest rates, perhaps now is the best time to get that beautiful vehicle you always wanted.”

Thanks, Bill! Suspect there are some great deals out there.

Another article that makes good sense! Thank you!

Thank you, Jolette!

Glad to hear it makes sense. I wanted to make sure people understood when it is the right decision. Ultimately, you have to do what you are comfortable with and can afford.