Original article published January 22, 2020

Coronavirus or COVID-19 is first and foremost in everyone’s minds these days. As it continues to wreak havoc with the entire world, unemployment rates are soaring to new heights in the US.

Last week, claims for benefits skyrocketed to 281,000 for first time claims. The jump in claims was a 33% increase, larger than anything that had occurred during the Great Recession.

How much will you get on unemployment insurance? Will you even qualify? During these trying times, is it going to be enough?

These questions stare every person in the face who has ever been laid off. Now, you have to figure it all out during this pandemic taking into account all of the new changes and rules.

Deciphering them can, not only, be overwhelming but scary and downright confusing especially with each state having their own set of rules.

Making matters even worse, most of the information is contradictory and depends upon which state you worked in.

Let’s be blunt, it is difficult to receive a straight answer to even a simple question. You can learn more about each state's rules at CareerOneStop.

1. How Long Does It Take to Get Unemployment Insurance?

Regardless of the coronavirus outbreak, you must meet your state's eligibility requirements to receive UI benefits.

Even though it varies from state to state, generally, benefits are only available to those who are out of a job through no fault of their own.

However, if you are employed and not able to go to work, you may be eligible to apply because of the current situation.

The government has allowed states to increase the eligibility for unemployment in light of this crisis. You could qualify for these benefits if:

Normally, some states do have a waiting period before you can start collecting UI benefits. Due to this pandemic, the waiting period has been waived to get the benefits processed faster. The exception is that larger companies with over 500 employees are not included.

Coronavirus is highlighting many of the deficits of unemployment insurance as workers submit claims in unprecedented amounts.

In general, to qualify for this benefit, you must have previously had at least six months of employment (or the equivalent amount of worked hours).

In any situation, you should apply as soon as you can to start the process. It’s the government and we all know it takes time for anything to be done!

Also, remember you can live and work in different states. Your claim should be placed in the state where you were employed.

Usually, the length of this waiting period is one week. You would, then, receive your first payment within two to three weeks of filing your initial claim.

Again, due to the outbreak, the government is doing their best to get the money in the hands of the workers as quickly as possible.

So, make it easy on yourself and provide the government with an accurate and complete claim. You should expect a phone call so being available, also, helps speed up the process.

Additionally, it does not help people such as gig workers, temporary workers and, in some states, part-time employees.

If you are self-employed, CreditCards.com offers a full guide on not only unemployment benefits but tax breaks, extensions and financial planning strategies.

2. What do You Have to do to Remain on UI Even with Coronavirus?

There are certain things you must do to continue to receive your benefits payments. This has not changed even with the outbreak.

They are:

Double check everything you are submitting to make sure it is as accurate and truthful as possible. Even if you make an honest mistake (which we all do), this could raise a lot of red flags causing thoughts of fraud to surface.

If you do not follow these steps, you could be at risk of losing your benefits. Though the issues should eventually be resolved, you’ll have to start your claim all over again.

3. How Much Will You Get on Unemployment by State (plus number of weeks)?

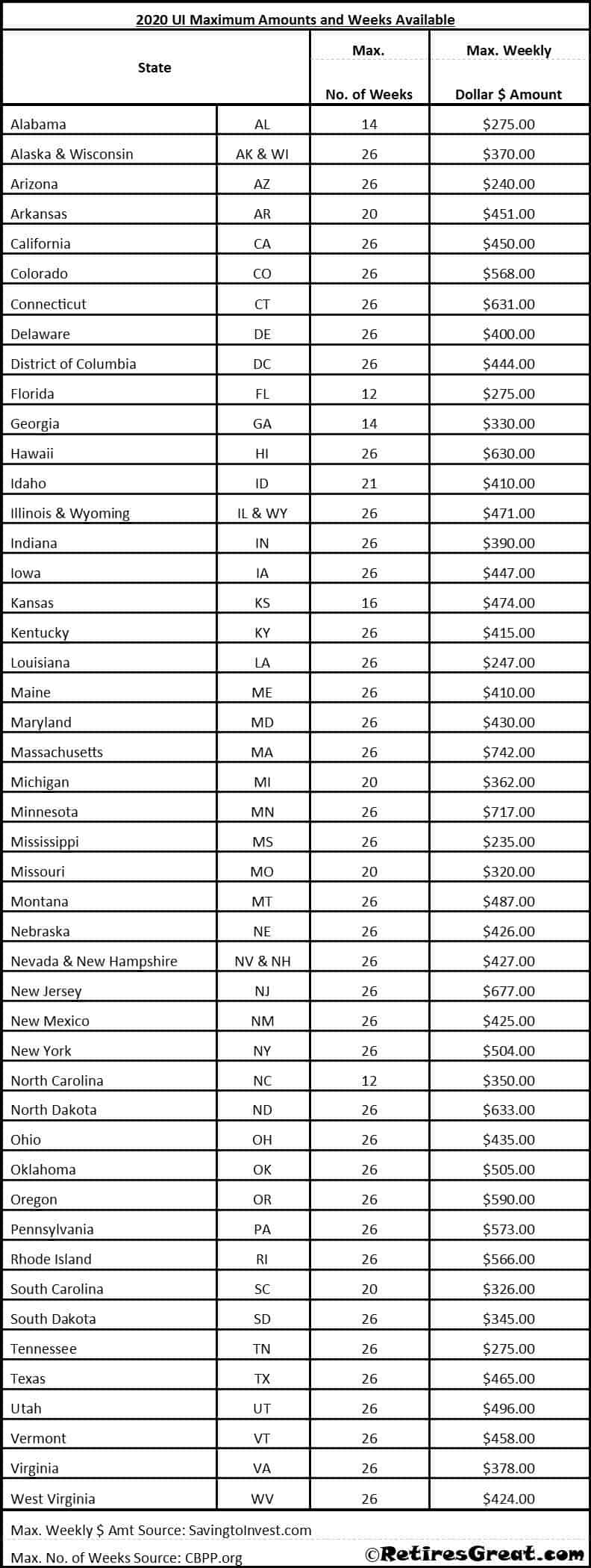

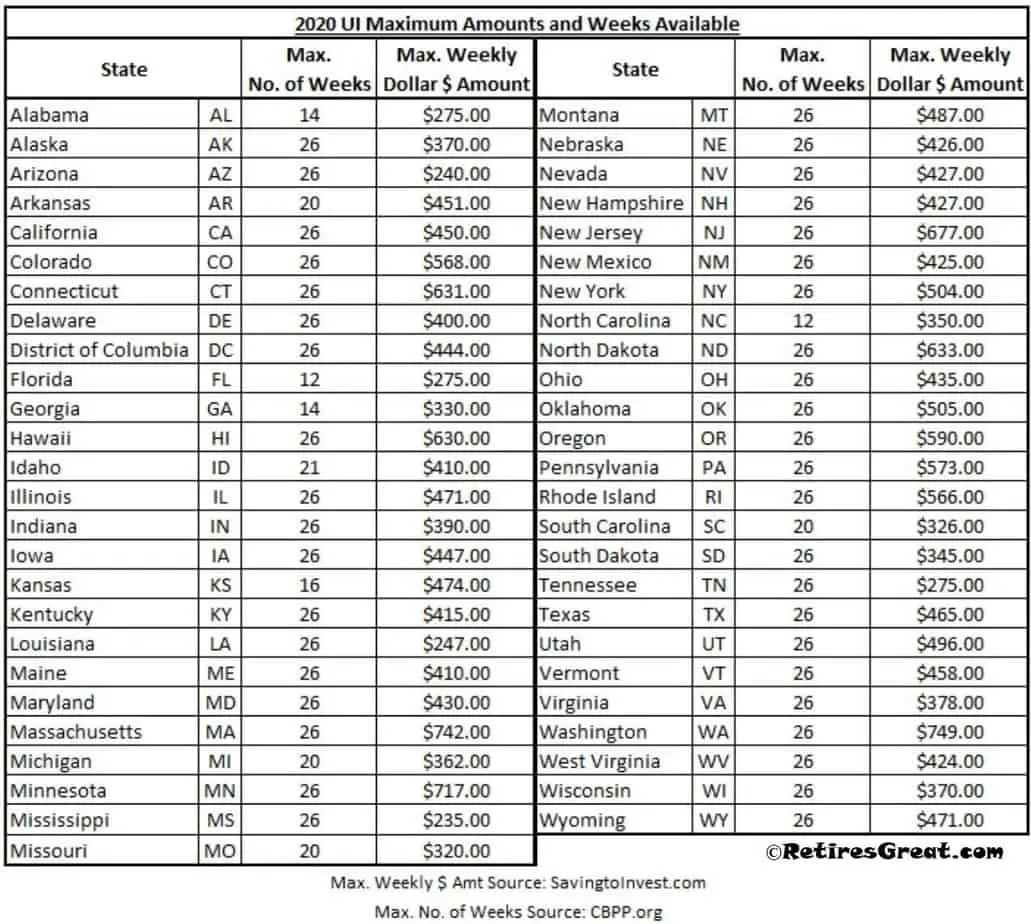

Most states offer 26 weeks maximum of benefits with some being as low as 12 weeks maximum (Florida, North Carolina). The maximum weekly dollar amount ranges from $235 (Mississippi) to $742 (Massachusetts).

How much you will get on unemployment is broken down by state in the chart below:

Each state has its own unemployment benefit rules so you should make yourself familiar with them. And, because of the outbreak, they are changing quickly so it would be in your best interest to keep updated.

For more information, Dave at Accidental Fire wrote a fantastic article including many awesome maps and charts from various sources.

They all present a more complete picture of the way things look as of right now. It's a great article with a lot of wonderful information.

4. Can You Collect Unemployment Insurance While Working?

In a normal situation, most states allow you to collect UI benefits while working a part-time or casual job. Half the amount you earn is deducted from your benefit up to a maximum of 90%.

Thus, your payments are pro-rated to incorporate this income. If you exceed 90%, your weekly benefit is zero and an additional week may be added to your claim.

Some states do allow a certain amount or percentage to be earned over and above UI insurance. Additionally, doing this helps supplement your income and could help you network to find a full-time job when the circumstances present themselves.

5. Does Severance and Vacation Pay Affect UI?

If you are let go or forced to retire, you could be offered a severance package. This could affect your UI benefits.

For example, if it pays you for eight weeks after your last day, the norm is that you won’t be able to collect until after that period has passed.

Vacation pay received can, also, affect your benefits. Some states deduct the whole amount while others only use a percentage.

Also, some allow a certain dollar amount of holiday pay before deductions to your payments are affected. Again, how much will you get on unemployment varies depending on your state laws.

Closing Thoughts on Coronavirus and Unemployment Insurance

The COVID-19 outbreak has put everyone on alert that we are not invincible. It is a very scary time we are living in right now. The economy is crashing, people are out of work, healthcare is over-taxed, and countries are closing their borders.

Depending on who you listen to, we are, either, in a recession or heading straight towards one. Nothing like this has happened in over 50 to 100 years.

In the best of times, unemployment insurance can help get you through that rough financial patch. How much you will get is easier to determine when you know exactly what the rules and details are to maximize your benefits.

Surprisingly, even when people are out of work in saner times, many of those who qualify for unemployment benefits don’t cash in. Eventually, this pandemic will be under control, you will go back to work, and the economy will recover.

However, the entire world will have changed forever. Our perceptions and views will have been drastically altered and, conceivably, for the better. We will have a “new normal” and way of life.

Hopefully, unemployment insurance will be seriously looked at and revamped to ensure everyone is better able to weather the next crisis.

Because, there will be another one, unfortunately! And maybe, just maybe, it won’t be handled with the mass confusion this cluster**** has been.