Without a plan how will you achieve a successful retirement? We all know planning and preparation are key; documenting this creates a personal roadmap.

The steps on how to write a retirement plan include:

Most folks spend more time planning their vacations than the next 20 – 30 years of their life. Either it seems too daunting to create a plan, they’re caught up in day-to-day busyness or they believe they’ve already figured it out.

Benjamin Franklin’s famous words “When you fail to plan, you plan to fail” may have more validity than most of us are aware.

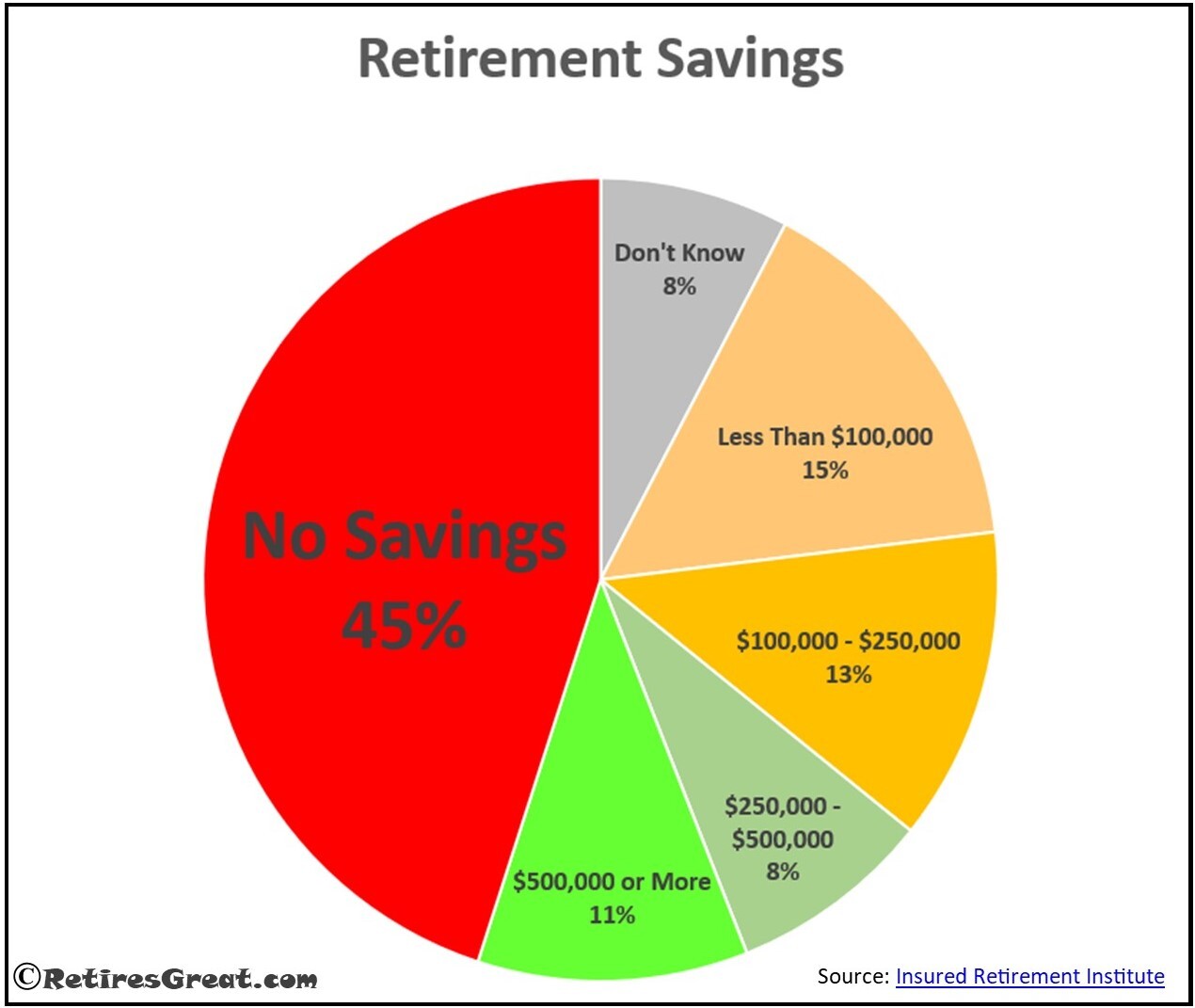

Shockingly, almost half (45%) of all baby boomers have no savings at all! Instead of a carefree wonderful retirement, most will struggle just to get by.

Unlike our parents / grandparents’ generation, traditional pensions are few and far between. Nowadays, the majority of workers have defined contribution plans where they need to contribute to a 401K or other investment strategy.

Instead of a guaranteed income for life, it’s up to each of us to take responsibility to save and invest wisely. The glaring facts are only a small percentage of people are properly prepared financially.

Our post, fear of outliving your savings, reveals how common and widespread this fear is. Even those with robust savings underlive what should be the best years of life.

If you write a retirement plan, the greatest benefit is the clarity and “peace of mind” knowing you’re on track. This is your life and the more thought you put into, the more likely you’ll experience the lifestyle you desire.

How to Create a Retirement Plan

Even for those in their 30’s or 40’s, there’s value in creating a retirement plan. These are the “accumulation years” and this becomes the roadmap to work toward.

Not only does a plan provide motivation, their investments have time to grow and compound.

As each of us gets closer to the age of retiring, the need becomes even more urgent. There’s less time to prepare and many may need to extend their working years.

When you write a retirement plan, the real value is you’re taking a realistic approach to ensure you achieve the lifestyle you want. As research has proven over and over again, writing down your goals leads to a greater chance of success.

How to Document Your Retirement Plan

This is a “living document” as things will change and evolve over time. My recommendation is creating a digital version to reference and update as required. This is your personal plan and only as valuable as the information you put in it.

The first step is defining your goals and what you want. This can be as simple as listing bullet points or expanding these into detailed sections. This is as much a thought-provoking process as one of documentation.

The second step is capturing your expected expenses. Our sample living expenses spreadsheet includes the most common monthly expenses. This in turn allows you to determine what you’ll require for annual income.

The third step is getting a handle on how much you’ll need to save. The best way is to use a retirement calculator and test different scenarios. Most provide a downloadable report which can be added to your document.

Following through and sticking to your plan is critical when it comes to saving, paying off debt and other action items. These should also be included and updated.

Finally, things will change and should be revised to keep your plan current. Let’s say you’re five years away from when you plan to retire. My suggestion would be to review and renew things on a quarterly basis.

If you’re married, include your spouse in this process. You’re going to need their support and, in all fairness, it’s their retirement too!

1. Define Your Goals and What You Want

The most fundamental question, what do you want?

This comes down to expectations and what you envision your retired life to be. Some folks plan on retiring on an ocean front property; whereas as others might desire a 55+ community.

Everyone has their own opinion of what would make them most happy.

Some questions to consider include:

Now’s the time to start thinking about what you really want out of retirement. When you write a retirement plan, it should be a thought-provoking process determining what you want your future to be.

What Age to Retire

The question of what age to retire is largely dependent upon financial security, job satisfaction and health. Many people extend their working years to pay off debt or maximize their savings.

Our post, should you retire at 62, identifies this being the most common age which happens to coincide with social security eligibility. Other factors can be disliking your job or when health issues creep in.

Compounding the problem is almost half of all workers retire sooner than planned. This highlights the need to be financially prepared, even if you plan on working longer.

Where to Live

Where you’ll live is another important consideration. For many people, they prefer to stay put, especially when their home is paid off and they like the neighborhood.

Other benefits might include being close to family and friends as well as amenities such as a doctor or dentist.

The drawbacks can be expensive repairs and ongoing upkeep. Not to mention all the equity locked up in the home. This is why downsizing to something smaller and easier to maintain can be an attractive alternative. Other options include:

By thinking about where you want to live, you have the opportunity to fully explore your options and what works best. For instance, if your desire is to retire in Florida, you should plan on spending time there to ensure it’s right for you.

Meaningful Activities

Long before your final day at the office, you should be exploring your hobbies, interests and other meaningful activities. Far too many retirees fail to do this and find themselves bored.

They never really thought about how they’d fill their days. Now that every day is like a weekend, how do you plan on spending all your newfound free time?

Ideas on meaningful activities are discussed in our post the ultimate guide of things to do when retired and bored. These can be thought of in four categories:

Some activities overlap other areas. For instance, pickleball is a fun way to keep active. It’s also socially engaging and you’re learning something new.

Another option is getting a job doing something you really enjoy. For example, a golf enthusiast might be in their 7th heaven working at a golf course.

2. Determine Your Expenses

Most people are oblivious to how much they spend on a daily basis. For instance, that morning latte is usually five or six bucks which can add up to over a hundred dollars a month!

Even going into the grocery store, we all over spend when something’s on sale or otherwise catches our eye. A valuable tool to better track spending is through Personal Capital's budgeting tools.

You might be a little shocked and decide to trim some things. Imagine if you had an extra couple of hundred each month to either reduce debt or add to savings.

Future Expenses

How much will your monthly expenses change?

Popular opinion suggests you’ll only need about 85% of your working income. Obviously, work-related costs will be eliminated.

Other reductions might include reduced car insurance as well as wear and tear. A second vehicle could also be sold.

A viable strategy is moving to an area with a lower cost of living. For instance, many states such as Arizona or Florida offer a warmer climate plus are less expensive.

In our post, pros and cons of retiring to Panama, we share how expats can live comfortably on their Social Security.

On the flip side, your monthly expenses could stay about the same or even increase. No longer will you have employer benefits such as health insurance which can be a major expense.

Even Medicare isn’t completely free as we review in our post Medicare simplified.

With more free time on your hands, all those fun things to do will cost money. Whether it be getting out on the golf course, dining out or travel.

All this underscores how imperative it is to have a realistic budget of your future expenses. Without one, how are you going to know how much you need to save?

3. Decide How Much You Need

From my perspective, achieving financial security is ensuring sufficient income to afford the lifestyle you desire. These could come from investments, Social Security, a pension (if you have one) and supplemental income such as part-time job.

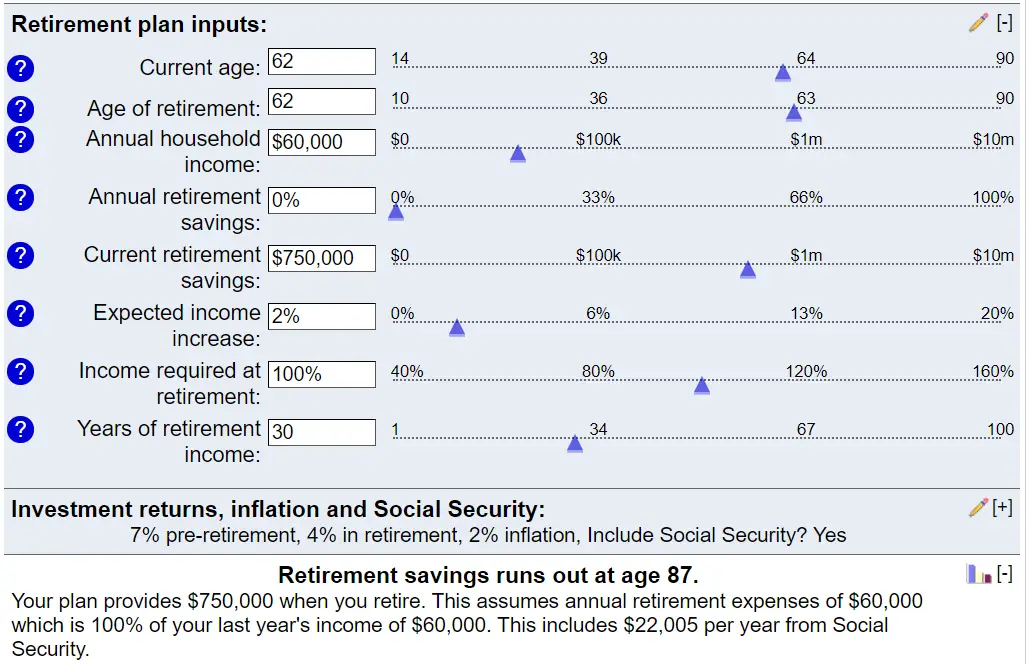

This is part of your financial strategy and a retirement calculator can reveal where you’re at. There are many free and some paid calculators on the internet.

Purely to provide an example, I used Bankrate’s calculator to create a scenario for a 62-year-old couple.

They have savings of $750,000 and desire an income of $5,000 a month (or $60,000 annually). Their income would come solely from Social Security and drawing down their investments.

According to this calculator, their funds would last until they turn 87 years of age.

I’m not endorsing this particular calculator as there are many available out there. I’m suggesting they can be a powerful tool in determining how much to save.

In addition, there are multiple variables to factor in such as inflation rate, return on investments (ROI) and even how long you expect to live.

Other Considerations

There’re numerous other considerations in optimizing an investment strategy. These could include:

If you’re not financially savvy or desire a professional opinion on your strategy, a certified financial planner (CFP) can provide invaluable guidance.

4. Execute Actionable Items

There’s going to be things which should be addressed while you’re still working. Neglecting them will create pain when you can least afford it. Some examples could include:

To expand upon savings, anyone over the age of 50 is eligible for an additional catch-up amount of $6,500. This could be an action item to maximize your savings while reducing taxable income.

Another example could be those who can’t pay off their credit cards each month. With the insanely high interest rates, eliminating this debt should become the highest priority.

In some situations, debt consolidation should be considered to get this under control.

5. Remain Flexible and Adapt to Change

The entire purpose of writing a retirement plan is thinking everything through and making the best possible decisions. However, everything will change over time. We need to remain flexible and adapt to change.

The Greek philosopher Heraclitus once stated “The only constant in life is change”. And that was back in 500 BC! There’s a lot of wisdom in those words. Since then, our world has been changing at an ever-increasing pace.

Think back twenty-five years ago when the internet was still new and flip phones were all the rage. What will the next twenty-five years bring? One thing I know is if we don’t keep up, we’ll be left behind.

With almost half of all workers retiring sooner than planned, this is something to remain aware of. Our needs and desires change as we age. All this becomes a moving target so nothing is written in stone.

Closing Thoughts on How to Write a Retirement Plan

Planning and preparing for your next stage of life might be the best investment of your time. When it comes to financial security and your happiness, it’s worth making the effort to fully explore all options.

The first step is defining your goals and what you really want. This includes when you’ll retire, where you’ll live, what you’ll do and anything else important. Once this is accomplished, everything else starts to fall into place.

Now you can better estimate your monthly expenses and how much you need to save. This also highlights areas to focus on such as reducing debt or increasing savings.

In spite of our best efforts, things can and will change. This requires flexibility and updating as required.

This is a life changing transition which many people will struggle with. By creating a personal roadmap, you’re in a far better position to achieve the retirement you deserve.

Some days I feel completely unable to plan ahead or budget in any sensible way, and it’s really frustrating.

Yes, it can be a little overwhelming. The first step is to start. Jot down some thoughts of what you want your retirement to look like. Basically, it’s a living document that you can add to later on. Thanks for stopping by!

I’ve been retired for five years and am loving it. However it did not happen by accident. I spent decades setting myself up for success, along with my spouse. We developed many shared hobbies, I designed a retirement part time career, we built an ample nest egg and eliminated all debt decades prior to retirement. Today we are best friends and buddies in our running, tennis, fishing, hiking and travel. Plus we have other friends to do things with so that we are not together 100% of the time. We are aligned on our goals and make decisions jointly. We are rarely bored. We stay in shape, my 65 year old wife is still running full marathons and we both play high level tennis. Volunteer work is a big part of my life and I consult for entertainment and mental challenges and money we do not need. I can’t argue with a thing in your post, it is pretty much how we’ve been successful at 42 years of marriage and 5 years of retirement.

You are a success story, Steve! It’s refreshing to hear how fantastic you have made your retirement. You’re living proof that a plan is the way to go.