Is retirement a slow death, the beginning of inevitable decline?

Why you should never retire began from a conversation with a close friend. He argued, quite passionately, he was never retiring. He dreaded the day he wouldn’t be able to do what he loved.

Needless to say, his sentiments caught me completely off guard! I've always thought of retirement as a reward after a lifetime of hard work. The more we talked, the clearer it became there are numerous valid reasons to continue working.

Reasons why you should never retire include:

To my utter astonishment, I further learned almost a quarter (23%) of the population have no intention of ever retiring. As my friend expressed, he couldn’t imagine sitting around doing nothing. For him, that would mark the beginning of his descent.

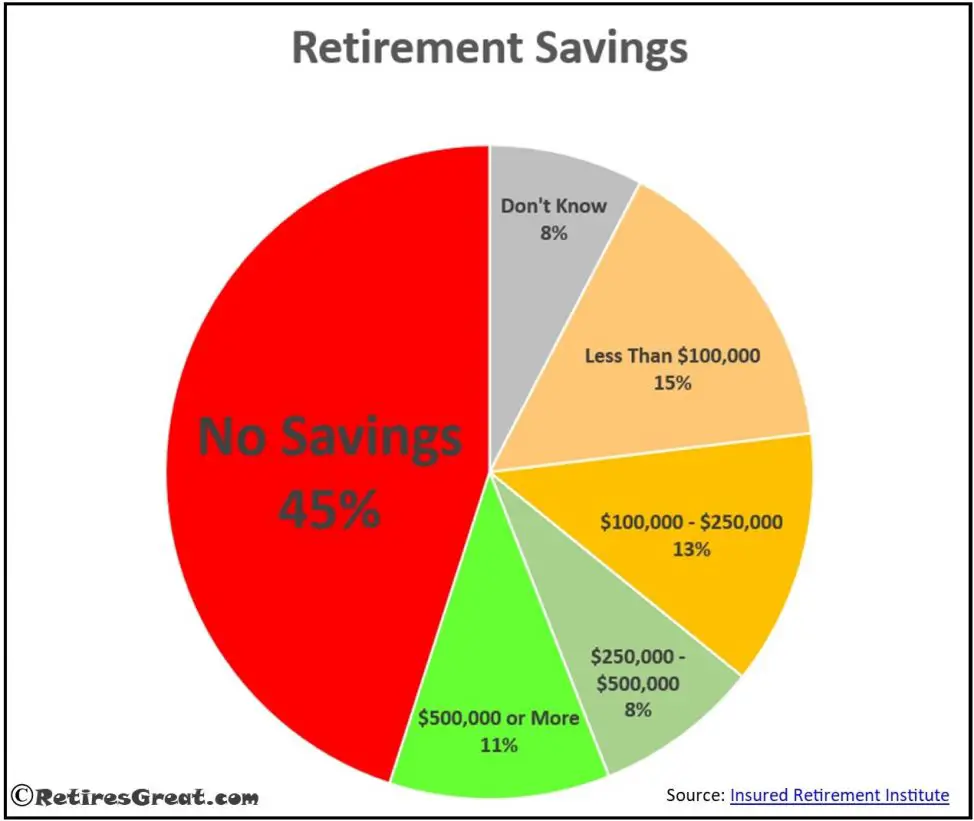

1. Insufficient Retirement Savings

If you haven’t financially prepared, it’s a moot point. And, around 3/4 of Americans have insufficient retirement savings. Unbelievably, almost half (45%) have no savings whatsoever! Only 11% report having saved $500K or more.

That means there’s a lot of people out there who may never retire. They can’t afford to not be getting a paycheck.

This is why it’s so crucial to prepare and plan. If you’re behind the eight ball or unsure of how to address this, see our post how to write a financial plan for valuable insights. Also, you might consider seeing a financial advisor.

2. Fear Of Outliving Your Savings

Fear of outliving your savings can drive some individuals to work far longer than they otherwise might. What started off as a couple extra years as a safety net can often wind up being many more.

Part of this fear stems from the rising cost of living. In our post baby boomer facts, it identified an average 65-year-old couple can expect to spend $285,000 on medical costs. And that doesn’t include long-term care!

Even for those who've saved a million or more, there are still many unknowns. With a volatile stock market and rising inflation, it seems safer to hold onto your job.

Our post greatest retirement fears addresses these fears and how to overcome them.

3. Job Satisfaction

Some of the benefits of working include:

From a different perspective, your employer imposes a sense of purpose. You’re expected to be on time, fulfil your responsibilities and, in return, receive a paycheck.

When you give this up, everything changes. You might feel lack luster and unmotivated. Which raises the question, what are you retiring to?

4. Nothing To Retire To

Work provides structure and something to do each day. Without it, how will you fill those 40+ hours each week? As the big day approaches, you might find yourself feeling anxious and questioning what it’ll really be like.

Not everyone has hobbies or interests they're passionate about. They never had time to develop this side of themselves. Their lives were busy raising a family and / or making a living.

Particularly amongst men, this is quite common. While they may have thought it’d be great to get out and improve their golf game, after a while that grows old. Then they’re puttering around the house trying to be helpful.

Meanwhile, their wives’ routines are completely upset. They feel like they’ve become in charge of entertainment. Our post, retired husband with no hobbies explores how disruptive this can be and strategies to address it.

The root of the issue is understanding what you’re retiring to and finding meaningful activities.

5. Desire For Social Interaction

Some of my best memories were of the people I worked with. Whether co-workers, customers or clients; that was what I enjoyed most about my job. The day I left, the majority of my co-workers dissipated into thin air. Our common bond was work.

Our post on loss of work friends goes into greater depth on this. Potentially after years together, your co-workers can feel almost like family. This can influence and even defer your decision to retire.

6. Keeping Active and Sharp

Most retirees slow down and begin relaxing in their new stress-free lives. If they’re not careful, this can lead to a sedentary lifestyle. Too much of a good thing.

Turns out this lifestyle, such as endless hours of TV or when the high point of the week is going grocery shopping, is really unhealthy and hastens mental and physical decline.

You may've heard the most dangerous years of life are the year you’re born and year you retire. Initially, I thought this harkened back to previous generations when life expectancy, more or less, coincided with the retirement at age 65.

Not necessarily so, according to the Journal of Population Aging. Those who retired were about twice as likely to be depressed. Another study by the London-based Institute of Economic Affairs revealed clinical depression increased by 40%.

There’s no question work helps keep you active and engaged. Research from TD Ameritrade found 66% of people plan to continuing working into their 60’s and 52% well into their 70’s.

Some of the reasons cited included:

7. Avoiding Feeling Unimportant

Retirement isn’t the most prestigious of occupations. In fact, it’s not an occupation at all, rather a stage of life. Yet, it often seems retirees are viewed as unproductive or even a drain on society. In spite of the fact, we’ve paid taxes for decades.

Somehow, we lose our importance when we’re no longer working. Not surprisingly, most of us reference our previous position if someone asks what we do.

For example, I’d confess I’m retired and immediately follow up that I was in the telecom industry for 25 years.

My point is this sense of importance is real. In some situations, for certain individuals, their identities have become intertwined with their professions.

Especially if they were in a position of authority. Examples might include law enforcement or fire fighters who deal with life and death situations.

Our post dealing with loss of identity examines this phenomenon. More importantly, this issue drives some folks to extend their careers to preserve their sense of importance.

8. Growing Demand for Experienced Workers

For years, some companies have ruthlessly downsized. Perhaps for the first time ever, they’re now concerned. Their most talented and experienced employees are walking out the door in droves.

Our post baby boomers are retiring faster than ever before uncovers a 213% increase over the past year! In many situations, the knowledge transfer to their younger counterparts isn’t happening. All their expertise and skills are not easily replaced.

According to Harvard Business, job vacancies have outnumbered applicants since 2018. In effect, the baby boomers are retiring faster than the millennials can replace them.

This demographic shift is creating growing demand for seasoned employees.

However, organizations need to adapt. To retain these valuable workers, they’ll need to offer more interesting positions, work from home options or flexible hours.

9. More People Are Deferring Retirement

Not all that long ago, 65 was the age of retirement. Except for a handful of professions (i.e.: air traffic controllers), age discrimination legislation now prohibits mandatory retirement.

The net effect is there are more older people in the workforce than ever before.

By 2025, it’s estimated a quarter of all workers will be 55 or older. The Bureau of Labor Statistics identifies the labor force of 65 to 74-year-olds is expected to grow about 55%. In contrast, the labor force as a whole is only expected to increase 5%.

Another factor is “reverse retirement” and returning to the labor market. The Federal Reserve Board reports over a third of retirees return, either, on a part or full-time basis.

The primary drivers appear to be financial necessity or the desire to do something interesting.

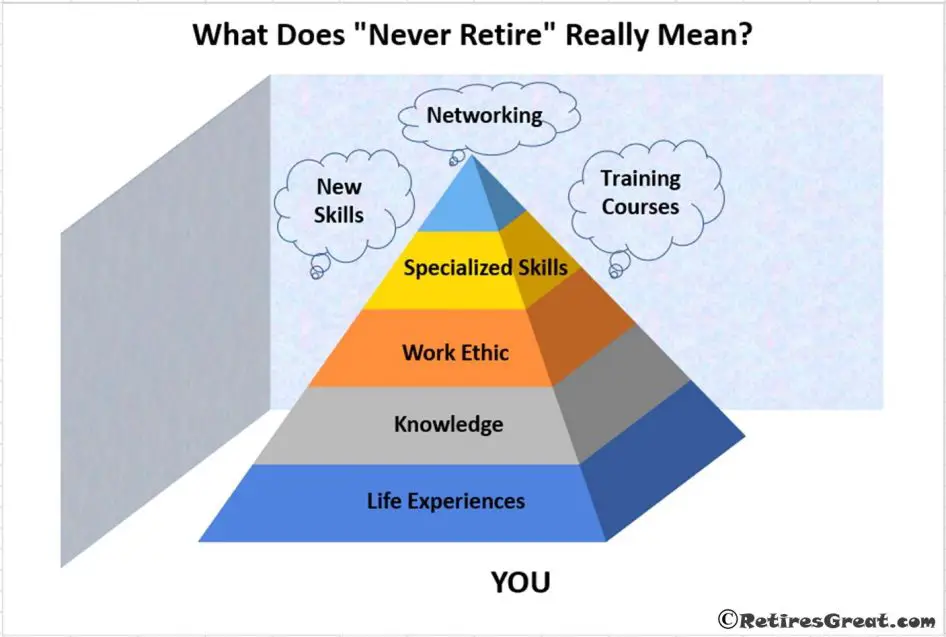

What Does "Never Retire" Really Mean?

On the surface, “you should never retire” sounds like working until you keel over or they haul you off to the hospital. Nothing could be further from the truth! What it really means is doing something meaningful and rewarding for as long as you desire.

This is leveraging all your life experience, knowledge, work ethic and specialized skills. Think of the pyramid as your base to build upon.

With a few tweaks such as upgrading a skill, a course and some networking; you may be in an excellent position to launch an entirely new career.

This might be in your field of expertise or something entirely new. Think of this in terms of doing something you enjoy whether it be full time or only as many hours as you choose.

While you might prefer slowing down and taking it easy, after a while boredom can set in. Our post, the ultimate guide of things to do in retirement outlines some ways to keep active and engaged.

"Never Retire" Career Options

If you're contemplating retirement, you may be at a crossroads of exactly how it'll look. Sitting back and “enjoying the good life” could wear thin quickly. On the other hand, you might've had quite enough of your stress filled soul sucking job!

Your Current Career

If you enjoy your profession, stick with it. This is where you’ll likely have the greatest earning potential.

You may have the opportunity to heighten your value by increasing your expertise. This could extend your career for as long as you desire.

Maybe you’re looking for a change and expanding into a related field. For instance, a plumber or electrician might have grown tired of doing the same old for so many years. With their expertise, they might be able to refocus on HVAC.

Another option could be working reduced hours or even becoming a consultant. If this appeals to you, consider discussing with your current employer. Based on the value and expertise you bring to the table; this might be a viable option.

Second Careers (Full-Time or Part-Time)

A friend of mine “reverse retired” after a year or so of boredom. One of his interests is woodworking so he was delighted to become a “kitchen consultant” for one of those box stores. He works around 20 hours a week and loves it.

As he said, “it gets me out of the house and gives me a bit of extra spending money”. Perhaps more importantly, he enjoys talking with people and helping them design their new kitchens.

There are many opportunities out there which might be perfect for you. For example, if you like being around people, becoming a tour guide could be interesting.

I recall the guides on the New Orleans Hop On bus and thought how much they enjoyed sharing their stories. That’s just the tip of the iceberg and there’s lots of interesting ways to earn some extra money.

Encore Careers

An encore career is pursuing an employment opportunity in something you believe in. Typically, these jobs are in the non-profit sector focusing on education, health, social services or the environment.

Even if a paid position is not immediately available, consider volunteering to “get your foot in the door”. You’ll gain valuable experience and skills that may pave the way to your perfect job.

A colleague of mine was active in the Boy Scout organization for many years. Something he really enjoyed and felt made a difference.

This evolved into him accepting an executive position. He confesses he spends longer hours than he ever did at his old job, but feels energized and inspired.

Starting Your Own Business

There may have never been an easier time to become your own boss. As a Boomerpreneur, you're in the unique position to leverage all your skills and knowledge creating your own income stream.

A recent study by the Census Bureau and two MIT professors determined the most successful entrepreneurs tend to be middle aged. Interestingly, a 59-year-old was 4.5 times more likely to succeed than a 25-year-old.

The reasons are our life experiences, social contacts and financial resources provide distinct advantages in becoming an entrepreneur.

However, starting a business is not for everyone. You’ll likely work harder than ever before and be challenged with learning new skills.

Yet, it can also be very rewarding. Doing something you enjoy and if you get it right, presents almost limitless income potential. With the internet and social media, there are numerous online opportunities.

This is particularly desirable for those who are tech savvy and willing to embrace change. In addition, this can be an attractive option for those with health or mobility issues.

Volunteering

At first blush you might question what volunteering has to do with never retiring. The only real difference is it’s an unpaid position. In fact, volunteering with your church or community is usually more rewarding than holding down a regular job.

This is an excellent way to keep active and interact with lots of interesting people. You also have the option of how much time you choose to contribute. This could range from an hour or two a week to a full-time position.

According to Urban.org, more than 6 out of 10 people over the age of 55 have volunteered in some capacity.

Closing Thoughts on Reasons You Should Never Retire

Why you'll never retire reflects traditional retirement isn’t for everyone. Most of us have another 20-30 years ahead of us and desire a meaningful and fulfilling life.

With almost a quarter of the population planning on never retiring, we need to look at things a little differently.

For some, it’s about financial need. Whereas others desire the social interaction and other benefits associated with employment.

The key point is doing something rewarding you enjoy. This can be related to your current career or something completely new and different.

To me, financial independence isn’t so much about retiring as it is pursuing the activities you enjoy rather than those you feel obligated to participate in. I am Team Never Retire, I just want a little more control over my time.

Excellent point! Love “Team Never Retire”!

It truly is a personal choice and more control over your time is really what it’s all about. This is the time of your life to pursue the activities you enjoy which may include work, whether paid or unpaid. Thanks for the comment!