Sure, you could pay a financial planner to create your plan, but why? At the end of the day, it’s only going to be as good as the numbers you provide.

We’ve made it easy when creating a financial plan for retirement. All you need to do is plug your figures into the free excel spreadsheet provided below. Plus, we even explain how to determine your future income and expenses.

What Is A Retirement Financial Plan?

Retirement planning sounds messy and unnecessarily complicated. It’s easier to use a financial advisor. Taking a DIY approach to preparing a plan will save you time and money.

You might still want to run your numbers by an expert and discuss more advanced aspects of your strategy. That’s a whole different conversation when you’re well prepared.

For the average person, it’s actually rather straight forward. You need to save enough money to support your future self. The best way to ensure you’re on track is creating a financial plan for retirement.

What Is the Value of a Financial Plan?

The real value is “peace of mind” you won’t outlive your savings. The folks that take the time to create a written plan are nearly 3X more confident they’ll achieve their goals.

What it’s really all about is determining your expenses and your future income streams.

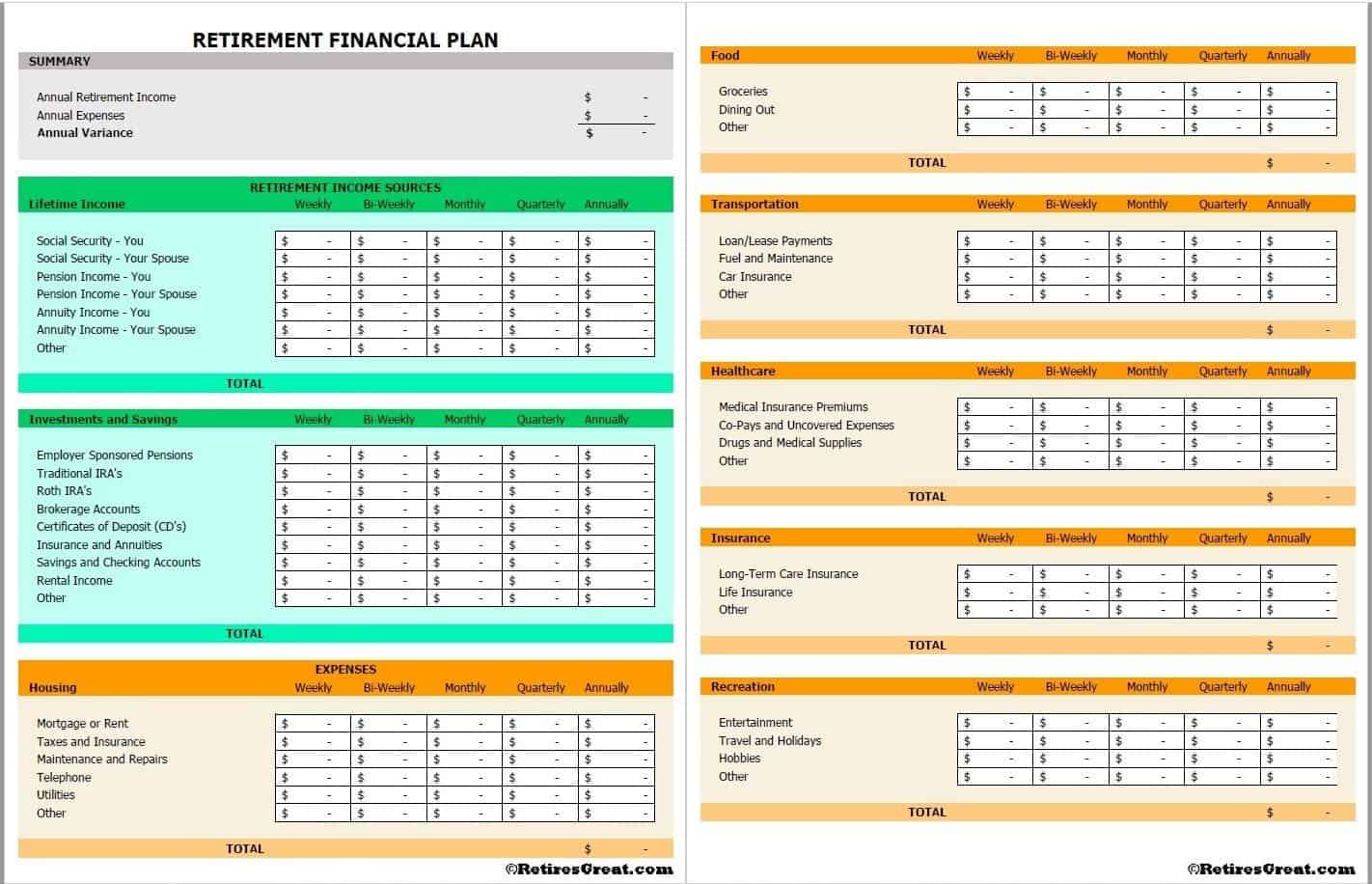

Sample Retirement Financial Plan

If you don’t manage your money, it will manage you!

The best way is to track expenses and understand how much income will be required to support your retired lifestyle. Below is a screen shot of a sample financial plan. You may notice how simple and comprehensive it is.

You can get (and download) your free excel sample retirement financial plan by clicking here.

Your Retirement Income

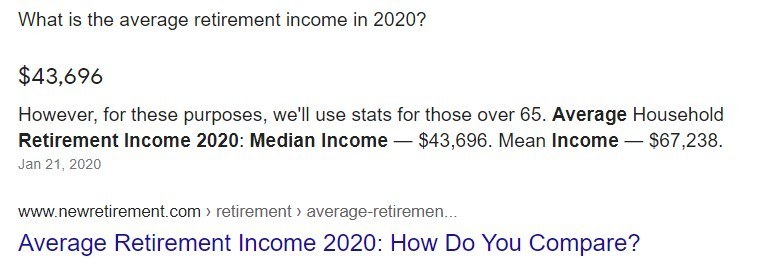

How much money do you want and need to enjoy a comfortable retirement? Interestingly, the average retiree income per household is $43,696 in 2020.

That works out to $3,641 per month. Could you live comfortably on that?

The answer really depends upon your desired lifestyle, where you live, and any unplanned situations such as declining health and related medical expenses.

The best advice I’ve ever heard is plan for the best while preparing for the worst.

Traditional Retirement Income

Back in the good old days, they often referred to the 3-legged stool of social security, a pension plan, and personal savings. Now, you’re in the minority if you’re eligible for a defined benefit pension.

Nowadays, few people have a defined benefit pension after working the bulk of their career for the same employer. In fact, most organizations no longer offer a traditional pension.

Instead they provide “matching contributions”. The employee is wholly responsible to save and invest for their retirement.

Today's Sources of Retirement Income

The world has changed and you need to understand where your future income will come from. Hopefully, you’ve prepared and will have more than social security to live on.

Unfortunately, almost half (45%) of all Americans haven’t prepared and have zero savings. Baby Boomer Facts and the Retirement Crisis reveals many of these challenges.

Expanding upon these income sources:

Estimating Your Retirement Expenses

The second part of creating a financial plan for retirement is getting a handle on your expenses. Best practice is to monitor all spending prior to retiring for at least a year. This ensures a clear understanding of where your money goes.

Most of us expect our living cost to decrease after leaving work behind. One rule of thumb suggests 70-80% of your pre-retirement income should be sufficient.

When you think about the daily commute, all those lunches, dress clothes, and other work-related costs; this sounds reasonable. Even more so, you might be putting aside as much as 15% into your retirement savings.

In spite of this, many retirees find is their expenses remain about the same or even increase! Now that they have more time, spending increases on entertainment and various activities.

Examples could include dining out with friends, going to the theater, or taking in more movies. Golf and other activities can also add up quickly.

If travel is on the horizon, it’ll further strain your budget. Whether you’re RVing across the country or flying to exotic destinations, factor these into your planning.

Typically, the three greatest expenses are housing, transportation, and healthcare. The first two tend to stay about the same, while healthcare can dramatically increase.

Without an employer benefit plan, you’re now responsible for the full cost of healthcare insurance.

Accurately estimating your expenses after retiring becomes crucial.

Housing Costs

Are you going to “retire in place”, downsize, and/or move into a retirement community? This decision has significant ramifications on whether expenses will decrease, remain about the same, or possibly increase.

For instance, your current costs aren’t likely to change if you remain where you are. Some folks may still have a mortgage payment whereas others might be renting.

Even with home ownership there will be monthly utilities, property taxes, and maintenance costs.

One way to reduce housing costs might be downsizing to a smaller living space. In addition, relocating to an area with a lower cost-of-living (and housing costs) will further save money.

On the other hand, a fancy retirement community could be much more expensive. Granted, they offer many additional amenities and support that may make them worthwhile.

Transportation Costs

Transportation costs should diminish with elimination of the daily commute. Right off the bat you’ll save on fuel, parking, insurance, and vehicle maintenance. How much will you save?

The greatest portion of transportation costs is your vehicle. Maybe you’re happy with your fully paid for car and good to go.

Lots of folks decide to upgrade their vehicle while they still have a paycheck and qualify for financing. They want something newer and dependable.

We all know an automobile is one of the worst investments possible. Not an issue if you can afford it, alternatively consider one two or three years old. Should You Buy a New Car Before Retirement discusses these options.

If you’re a two-vehicle household, it might make sense to sell one if it’ll seldom be used. This eliminates insurance, registration, and the depreciation of the second vehicle.

Healthcare

Healthcare continues to become more and more expensive. As previously noted, the loss of employer benefits will likely increase your cost of healthcare insurance.

Shockingly, an average American couple are can expect to pay $285,000 throughout their retirement. That was in 2019 and the number continues to rise each year.

Even when you’re eligible for Medicare, expect significant additional expenditures. This consists of co-pays, out-of-pocket fees, and/or additional health coverage.

There are numerous areas not covered by Medicare such as prescriptions, vision, hearing, and dental.

Entertainment and Travel

These are supposed to be the best years of your life. If you don’t budget for them when creating a financial plan, you’ll either be shocked by how much you’re spending or simply avoid doing them.

It really is a paradox, after working all your life you deserve to enjoy the “fruits of your labor”. These should include any activities and getting together with friends.

Travel can become a big-ticket endeavor after booking flights, accommodation, and all the other stuff. If these things are important, plan and budget for them.

Other Expenses

We’ve covered most of the “biggies”. You’ll also want to be aware of all those other expenditures. You might be surprised with how much is frivolously wasted.

Nowadays, everyone uses their credit card when purchasing something. The monthly statement can be a minor shock. Unbelievable how quickly things add up.

If you’re behind on credit card debt, either get it paid off or look into debt consolidation.

Closing Thoughts on Creating a Financial Plan for Retirement

The most important thing is to know what your income and expenses are going to be in retirement. Get your free spreadsheet here and prepare your plan.

As critical as the financial aspects are, there’s lots more to consider in designing your dream retirement.

How to Write a Retirement Plan addresses the importance of relationships, meaningful activities, and health considerations. This will make doubly sure your golden years will be happy, healthy and the best years of your life.