Should you retire at 62 or work a few more years is a question many ask themselves. After a lifetime of hard work, you might be eagerly anticipating the day you can leave it all behind. Slow down and enjoy life.

Retirement at age 62 affords you the freedom to do whatever you want, while you’re still healthy enough to enjoy it. You should consider retiring if you’re financially prepared and ready to explore the next chapter of life.

Reasons to Think, Should You Retire at 62

When you think about it, there are some really good reasons to retire at 62. Most of us are still healthy and active enough to start enjoying our life.

Like doing all those things we never had time for while we were working and couldn’t fit into our vacation time. These really are your “go” years, when most people start checking things off their “bucket list”.

If you’ve always wanted to climb Mount Everest or hike the Inca Trail, this would be a great time. Maybe visit all the national parks with a cross-country RV trip or drive the Alaska highway.

The best part is, you’ve got the freedom of time to see and do whatever you want. Another bonus is getting out of the rat race while you’re still healthy and have your sanity.

For some, the stress and working conditions at their job could be knocking years off their life. We’ve all heard stories of how someone’s job was slowly, but surely killing them.

While they might’ve stuck it out to the bitter end, shortly after leaving, they keeled over. Getting rid of those stresses can make all the difference in the world.

My wife was in one of those situations. Her supervisor was an arrogant bully - a real “bosshole”. It became so toxic; she didn’t even want to get out of bed in the morning to go to work. It got to the point it was seriously affecting her health.

Thank goodness we could afford for her to jump off that crazy train for good! Life is too short and we need to make the most of our allotted time.

Have a Plan

Most folks never take the time to write out a plan. Only about one in five couples discuss and document what they want their retirement to look like. And, even those, tend to focus on the financial aspects only.

In effect, they assume everything will work out or they’ll figure it out as they go. This is a big mistake as, often, they have quite different expectations.

For instance, she wants to travel more whereas he’s fretting about how expensive everything is. You just know they’re in for a bumpy ride.

To avoid these kinds of misunderstandings, you’ll want to work through all the details with your spouse. Some of the things to include:

How to Write a Retirement Plan outlines all those areas that should be worked through before deciding it's time to leave.

What Are You Retiring To?

This is a mindset shift. Instead of thinking about “retiring from”, you should focus on what you’re “retiring to”. These should be the best years of your life.

There’s nothing wrong with slowing down and enjoying life. However, putting your feet up and watching endless TV, that’s gonna get boring. Plus, it’s unhealthy to sit around doing nothing.

What’s going to keep you occupied and replace those 40+ hours of work? While it’s nice to slow down, it’s not a permanent vacation.

As much as I’d love a world cruise I suspect, after a while, I’d go stir crazy. Not to mention it would probably cost a hundred grand.

Early retirement is really the chance to start living your dreams. Do something meaningful and fulfilling. Without a doubt you’ll want a plan that aligns with your spouse.

Together, these could be the best years of your life. One of the most frequent complaints is boredom and not finding something interesting to do. The Ultimate Guide on Things to Do offers some fresh ideas on this.

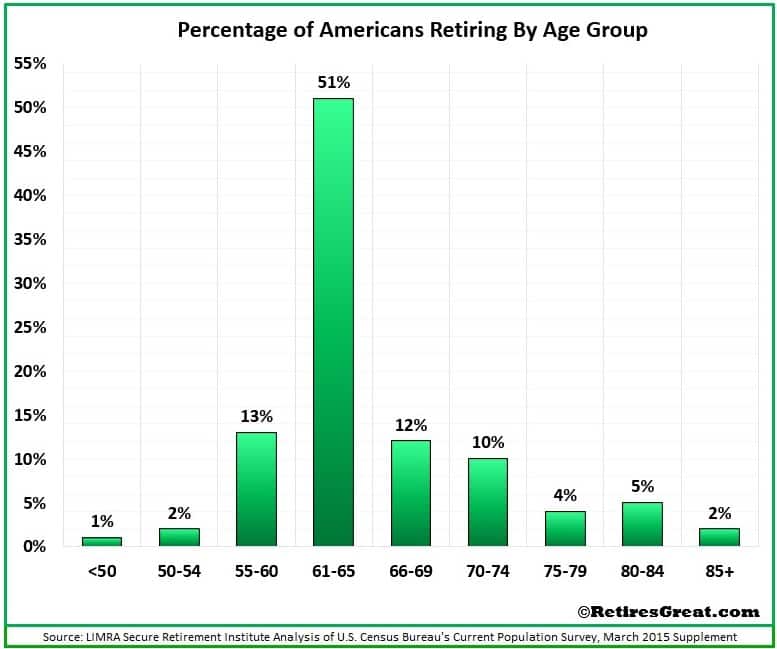

How Many People Retire at Age 62?

Over half of all Americans (51%) retire between the ages of 61 and 65. The peak is at age 62 with 18.7%.

What's really eye-opening is most of them didn’t plan it! In fact, over half of all older workers will retire sooner than they anticipated. This can be due to job loss or health issues. In a large survey, TransAmerica Center for Retirement Studies, found 69% of baby boomers expected to work until 65 or longer.

How Much Does the Average Person Need to Save by 62?

Most financial experts recommend a nest egg of at least $1 million dollars! One rule of thumb is setting aside 20 times your annual income. With the average American household earning $60,000 a year, they should’ve saved $1.2 million.

Further, the “4% Rule” suggests you could safely withdraw 4% each year. Your retirement income would be $48,000 plus any other income streams such as Social Security. Assuming all goes well, you’d never need to touch the principal.

How Much Has the Average Person Saved by 62?

The sobering truth is the majority of baby boomers are way behind in savings with the median around $152,000. Assuming living expenses of $48K a year, they’d quickly run out of money.

Even with Social Security, they’d likely run out within 5 years.

What if You Haven't Saved Enough?

This is a widespread issue and it’s not realistic to retire without a sufficient source of income. This raises the question of what's the absolute minimum you’d need for a reasonably comfortable retirement.

Enough money to last, say until you turn 85. Rolling up our sleeves, we crunched the numbers in How Much Do You Need to Save.

Based on an income of $48K, dual Social Security, and a 6% return; theoretically, a couple would be okay with $430,000. If you haven’t saved enough, your options could be:

Living Expenses in Retirement

The other side of the equation are your living expenses. According to the latest federal data, in 2019 the national average household spending (led by someone 65 or older) was $50,220 a year.

This reflects reduced spending after retiring as the average across all households was $63,036. To get a better handle on determining your expenses, see Creating a Financial Plan.

Cost of living varies across the country and by relocating to a less expensive state (or country), your expenses can be less. For example, numerous expats report living comfortably on just their Social Security.

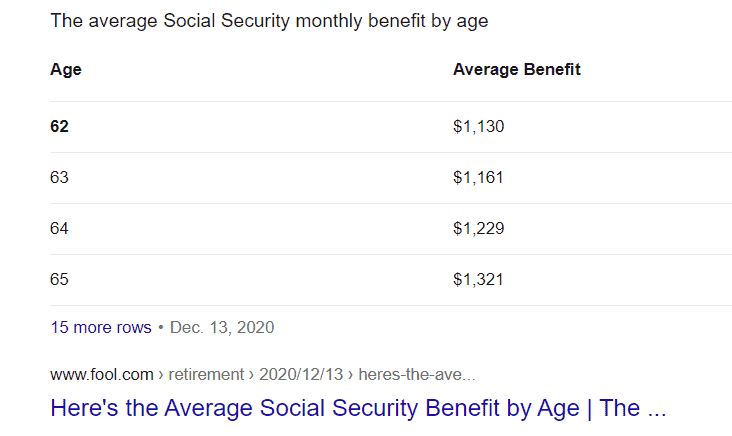

What is the Average Social Security Benefit at 62?

You could receive a benefit of $1,130 a month. To determine exactly how much you’re eligible for, you’ll want to check on the Social Security website.

Also understand, your benefit increases by about 8% for each year you defer. And, the good news, you’ll receive it for the rest of your life.

How Many People Take Social Security at 62?

Perhaps it shouldn’t be a surprise over a third of all Americans enroll for their benefits as soon as they’re eligible.

What you’ll receive increases by about 8% for every year you delay. So, some retirees hold off to maximize their benefit. If you wait until you’re 65, you could be getting $1,321 a month.

While that sounds good, it raises the point of what is the breakeven? If you enrolled when you turned 62, you’d receive just over $40,000 during those first three years.

At age 65, you’d get about $190.00 a month more. It wouldn’t be until you’re 81 years old before you caught up! When you consider this, I’m surprised more people don’t take early benefits.

The TransAmerica finding also indicates 42% of retirees are dependent upon their benefit as a primary source of income. These folks are in no position to wait as they need the money now.

Another consideration is the viability of this underfunded program. No one knows what will happen, but the future of Social Security is at risk of collapse by 2029, unless major changes are made.

In other words, it might make sense to get what you’re entitled to before everything melts down.

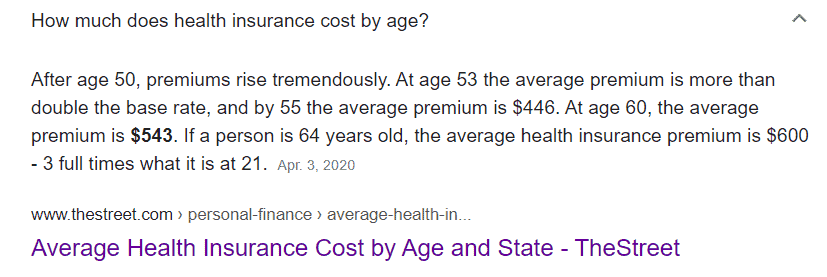

How Much Does Healthcare Cost at Age 62?

Another big consideration for should you retire at 62 is the cost of healthcare insurance. This is usually one of your greatest expenses, increasing dramatically with age.

Until you turn 65 and Medicare kicks in, you could be footing a hefty premium.

Private insurance is typically the most expensive; although, it can also be the most comprehensive. Other options worth investigating include:

Closing Thoughts

Hopefully, should you retire at 62 helps guide you on this important decision. While, income is critical, so is your well-being. Like most things in life, everything is a trade-off.

"No one on their death bed has ever said I wish I had spent more time at the office."

Paul Tsongas

What age to retire compares additional options. Only you can answer if slaving away a few more years is worth it. It’s your life. How do you want to live it?