Ever wonder about the history of retirement and what it might have looked like at the turn of the century? This is Jack’s story, a proud hardworking firefighter faced with retiring.

Grimacing with pain, his worn-out knees shrieked with each step as he plodded homeward. Pulling up his collar to ward off the icy drizzle, the thoroughly miserable evening perfectly matched his glum mood.

Jack knew he should be grateful. After all, tomorrow was his 65th birthday. The guys down at the fire hall were making the final arrangements for his party. He loved them all and they had become his real family. After all these years, he was saddened by the realization that everything was about to change. He wouldn’t be seeing his buddies every day.

The drizzle turned into sleet, triggering memories of last Sunday’s funeral. The passing of his youngest brother had shaken him deeply. In spite of the turnout of friends and well wishers, he had never felt so terribly alone. Every day he missed his dear wife and the happy times they shared. Now he was the last, a stark reminder of the gaping emptiness in his life. It was a cruel twist of fate that he, the eldest, had outlived all seven of his brothers and sisters.

Intense pangs of loneliness cascaded through him as he approached the front step. He knew he would always be welcome at the fire hall, but everything had changed. Old and put out to pasture, he dreaded what his future would become.

Where Does the Word Retirement Come From?

The word “retire” stems from the mid 16th century French words “Re” (back) and “Tirer” (draw), literally meaning to draw back to a place of safety or seclusion. Thus, the term was used, at the time, for armies and meant they were to withdraw from action or danger.

According to Wikipedia, “Retirement, or the practice of leaving one’s job or ceasing to work after reaching a certain age, has been around since the 18th century.”

Prior to this time, average life expectancy was between 26 and 40 years. It was not until the industrial revolution and an improved quality of life, that the age started to increase.

In fact, life expectancy has now doubled. As a result, the term has become outdated. Today, as retirees enter the third stage of their lives, most are unwilling to move into that sedentary lifestyle of our forefathers. They are actively looking to make these next years the best years of their lives.

When Was the Concept Created?

In retirement history, we observe military pensions dating back as far as Roman times. Actually, the concept is relatively new. Beginning only in the mid 1800's, the first pensions began with municipal positions such as police and firefighters.

Arguably, it was because they had become too old to safely and effectively do their jobs. Back then, people just did not stop working.

With pensions, the ones that could not take care of themselves had, now, been given a way to survive their remaining years. As well, this gave a means to replenish the aging work force with younger people.

Originally, this concept was not received in a positive manner. “Mandatory retirement” was not something people wanted, desired or thought was fair. They wanted to work, feel productive and continue earning a salary.

With private and government pension plans, rising wages and federally funded assistance programs, the concept became more tolerable and acceptable.

And, also, it was legislated that it was no longer mandatory. These changes were all positive and effective contributions to getting social acceptance.

Private Company Pensions

Most businesses were small or family owned with employees having a job for life. If you research the history of retirement, American Express initiated the first private pension plan in 1875.

Interestingly, the criteria consisted of 20 years of service, attaining the age of 60, and recommendation by a manager. Further, this was subject to approval of a committee and the board of directors.

Soon, the railways and banking companies began to offer employee pensions. By the turn of the century, some of the larger more progressive corporations also offered pension plans.

In addition to attracting better loyal employees, it provided a more humane way to maintain a younger workforce. The Internal Revenue Act of 1921 exempted tax on contributions to employee pensions paving the way for greater acceptance of the plans.

Financial security in old age became a rally cry for labor unions throughout the 1940's. The onslaught of World War II and labor scarcity inspired many companies to offer pensions to attract workers.

By 1950, about 25% of the private sector workforce had a pension. A decade later this had grown to 50%.

Government Pensions History

Otto Von Bismarck

Believe it or not, the first official government recognition of retirement was influenced by the threat of Marxism. According to Social Security Administration, “Germany became the first nation in the world to adopt an old-age insurance program in 1889.”

The Marxists were growing in power and popularity demanded radical alternatives. The “Iron Chancellor” Otto von Bismarck introduced the first state social insurance promoting well-being of workers whether disabled by age or health.

By many, this was a radical maneuver labelled as socialist. And it took eight years to get approval. This mandatory program was funded with contributions from employees, employers, as well as the government.

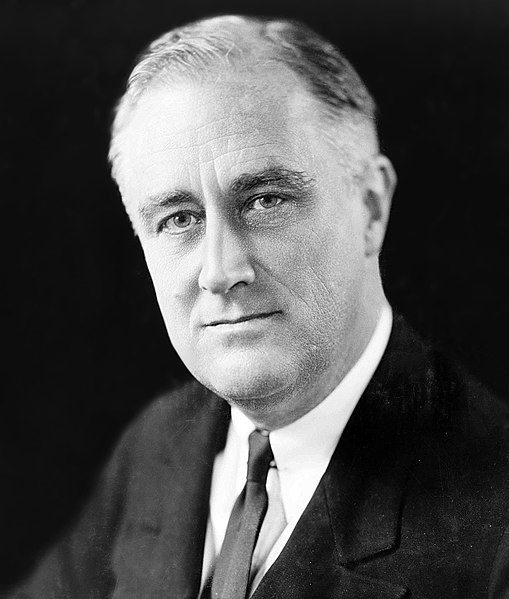

At the height of the Great Depression, President Roosevelt introduced his “New Deal” in 1935. The Social Security Act established a federal social safety net for the elderly, unemployed, and disadvantaged.

This was never meant to be a government financed plan. The intent was people and employers contribute a portion of employee work income creating a pool that would be paid out in old age ensuring future economic security.

Initially, the contributions from currently employed workers were used to support those in need.

Franklin D. Roosevelt

Where Did the Official Age of 65 Come From?

In the beginning, the German government deemed the age of 70 as the appropriate age for retiring (Bismarck himself was 74 at the time). And there was, undoubtedly, concern on how this would be financed.

It was only in 1916 that the age was reduced to 65 and, effectively, became the standard throughout the world for the most part. The American Social Security Act of 1935 followed suit establishing 65 as the standard age.

This was half a century before the discovery of penicillin and other medical breakthroughs, a time when people did not have long lives.

Over the past several decades, average life expectancy has increased. So, the official age has had upward pressure. For example, social security benefits are reduced if you retire prior to 66 and four months.

With the demographic trend and surging volume of baby boomers retiring, there is a concern that funds are dwindling.

Can You Make Someone Retire at 65?

For the most part, it is unlawful to force someone to retire. The Age Discrimination in Employment Act of 1967 (ADEA) protects individuals from discrimination based on age. Prior to that time, retiring was mandatory once reaching the age of 65.

Exceptions to this legislation occur in occupations that are either deemed too dangerous or require high levels of physical or mental health. Examples include military personnel, law enforcement, judges, air traffic controllers, and airline pilots.

What is the Earliest Age to Collect Social Security?

Sixty-two (62) is the earliest age you become eligible to apply for social security. The Social Security Administration identifies you will receive 73.3% of the funds as compared to deferring it until 66 plus 4 months.

Keep in mind you would have been collecting it for 52 months at that point. It probably doesn’t make sense to apply for social security unless you are retired or ready to retire.

This may be dictated by health concerns or a stressful unfulfilling job. When you really think about it, if you don’t like your job or have a bad boss, consider the true cost of working those extra years?

It becomes a trade off between what is best for you against those few extra dollars.

Do Pensions Last for Life?

Traditional company pension plans are defined benefits providing a fixed monthly annuity for the rest of your life. Your amount is based upon years of service, contributions, and the age you stop working.

A properly managed fund should never run out of money. In the event that the fund couldn’t meet obligations, the Pension Benefit Guaranty Corporation (PBGC) would take over.

As a federal entity, the PBGC was created in 1974 to protect pensioners. Also, social security is a type of pension that you have contributed to throughout your working life.

No one knows what will happen for sure, although it is probable we will see changes as trust funds are projected to become exhausted by 2037 (for more details, see Baby Boomer Facts).

What Does Retirement Mean Today?

Never before in the history of retirement have we had so many options. Now, we are living longer, healthier lives than ever before. This is changing the way we think and view the entire concept.

Our thoughts are more aimed towards a third phase of life, and reinventing ourselves with greater purpose and meaning.

Traditional Retirement

You might think that retiring is the opportunity to slow down and enjoy life. Generally, this means spending more time with family and friends. A life of leisure pursuing new and old interests / hobbies.

Examples might include travelling, photography, fishing, or anything else you have a passion for or would like to try. Whereas all this sounds wonderful, most things cost money.

With oodles of free time yet on a fixed income, many of these interests become too expensive. Boredom can easily set in with the days filled with meaningless activity. This leads many to decide that the traditional way is not for them.

Semi-Retirement

The advantage of only semi-retiring is your days become more structured with something to look forward to. Getting out of the house and interacting with others can be very important for some.

Although the extra income of a part-time job is nice, usually it is not about the paycheck. It is about doing something you enjoy and gaining the satisfaction of helping others.

There is a growing trend of retirees re-entering the workforce. It may be as a consultant in an area of expertise or simply something you enjoy. Examples might include working at a golf course, a greenhouse, or becoming a local tour guide.

Early Retirement Options

Whether forced upon you or it is voluntary, retiring early has become more prevalent. Corporate downsizing, health issues, and job dissatisfaction are the primary reasons.

The majority of us do not have the financial resources to sustain 30 or more years after stopping work. Simply stated, we will outlive our savings and other options need to be explored.

Expat Communities

Another trend we observe is Americans relocating to foreign countries where the cost of living is substantially lower. Many report they maintain a comfortable lifestyle on a social security income.

An added benefit is that health care costs are also significantly lower. Growing “expat” communities exist in many countries such as Costa Rica, Panama, Belize, and Mexico.

This is not for everyone and it is strongly recommended you live, at least several months, in the country before making the decision where to live. There is a lot of information out there showing the pros and cons of each country.

Business Opportunities

When you think about it, it makes perfect sense for retirees to become entrepreneurs. They have the time, expertise, and usually the finances to start their own business.

In fact, the largest growth of new entrepreneurs is the age group of 55 – 64, reports the Huff Post. Ideally, the wealth of experience over their careers positions them to start their own businesses.

Not only that, but the over-50 set is looking differently at their post-work years, says Michael Chodos, associate administrator for entrepreneurial development with the United States’ Small Business Administration. “Folks are coming into their second acts healthy, with vast experience and see another 30 years in front of them.”

According to a study by Babson College, more than half of all small business owners were over the age of 50 in 2016. Further more, 70% of these ventures were still in operation after five years as compared to 28% by younger entrepreneurs.

Closing Thoughts On History of Retirement

Retirement has changed and evolved dramatically over the past several decades. What started out as a way to bring in new young workers has now become the next chapter in our ever changing, ever expanding lifetime.

We are living longer healthier lives with greater expectations that these, truly, are our “golden years”.