What age to retire might be best viewed as how much longer do I have to work at a job that no longer fulfills me?

Whether you hate your job, are burnt out from the daily grind, have health concerns or want some more time to yourself, you may be thinking and asking yourself when can I leave all this stress behind.

The reality is few of us retire when we initially planned. Financially, we all know we should work until, at least, 65 yet the trials and tribulations of work may be taking years off of your life.

Statistically, the most common age of retirement is 62 which, coincidentally, is the earliest you can draw social security.

Other considerations staring you in the face might include health issues or the desire to life live while you still can.

Money isn’t everything and can't buy happiness! The financial gurus suggest you need to save at least $1 Million which is, clearly, unrealistic for most of us.

Reasons to Retire

When to retire is a personal decision for each and everyone of us. The bottom line is that you can retire whenever you want.

Generally, the decision is made based on your unique situation including your finances, health and what ever else is happening in your life.

The following describes the most common reasons people retire:

- Tired of work – Some people recognize they need change and to escape the 9 to 5 daily grind. Exchanging their time and effort for a paycheck is no longer fulfilling.

- Health issues – When serious health issues arise, either for yourself or a significant other, it may trigger retirement. Life is too short and it becomes more important to enjoy whatever time we have left and make the most of it.

- Age – After a lifetime of working, certain ages become the markers of when to retire. For example, at 62 you can draw social security. Alternatively, at 65 you are covered by Medicare. Both these ages are significant milestones for those planning their retirement. For those with a pension plan, retirement may be determined by achieving a certain number of years of service.

- Forced retirement – Some employers downsize and target older employees perceiving they are more expensive and have lower productivity. Unfortunately, “ageism” is all too real and rampant in today’s labor market. Even with a wealth of knowledge, experience and skills it can be challenging to find a job once you are fifty plus.

- Financial freedom – Through hard work, diligent saving, and wise investments, some people have achieved their financial freedom to retire. In other situations, some may receive an inheritance or win a lottery.

What Age to Retire?

Rather than focus on what age, maybe the real question should be when is the best time to retire for you.

My wife and I discussed this extensively prior to her leaving a toxic work environment where she was completely undervalued by a self-important arrogant boss.

Age 55 may not be the optimal retirement age; however, the stress had gotten to the point it was seriously affecting her health.

If you want to learn more about the challenges she went through, her Bad Boss article chronicles the hell she went through making this decision.

No job is worth it when it begins impacting your health! If you are unhappy, it is a time to explore options that are better suited for you.

These might be finding a different job or, alternatively, deciding it is time to retire. For others, retirement consists of leaving their career and pursuing something they enjoy.

Also, financial considerations will influence when is the best time to retire.

Can You Afford to Retire?

To be candid, your savings/pension and social security need to support a comfortable lifestyle for you in retirement. Everyone is different with vastly different expectations and/or needs.

For example, if you desire a modest lifestyle, you might be able to achieve this simply by downsizing and reducing your costs.

Alternatively, others may want to travel the world and require a great deal more disposable income. This will require more savings and, likely, working longer.

Can you afford to retire requires reviewing your expenses and what you really need for the lifestyle you desire. These steps include:

If everything lines up financially, you should enjoy a comfortable retirement. For most of us, we are going to be a bit short and compromises will need to be made.

Retiring on Your Own Terms

To retire on your own terms requires you to have a clear vision of your value to your organization and what it is you want and need.

Once you “pull-the-plug” and retire, it is often difficult if not impossible to return to your old job or even find a similar position.

If you enjoy what you do, don’t rush into retirement just because of your age. Perhaps you desire more time to enjoy life or have a “bucket list” of travel destinations.

There may be opportunities to discuss with your employer options of either reducing work hours and/or taking extended time off. For instance, a friend of ours winters in the Caribbean.

He is still available on a consultative basis for six months of the year. Although his income is adjusted, it sure seems like a sweet deal.

Perhaps an African safari or some other adventure has always been your dream so why wait for retirement? Consider using any unused vacation time or even taking a leave of absence.

Do what is important to you now while you are youthful enough to fully enjoy! Also, it will be easier to pay for it while you still are working.

After you retire, the cost will likely be a major hit to your retirement savings.

55 - Can You Really Retire?

You can retire at any age; however, you will likely live three more decades. According to the Social Security Administration, a man can expect to live to 84 while a woman’s age is 86.4.

Most of us are not financially prepared for full retirement at 55. Early retirement has numerous financial implications. First of all, you will need more money saved to carry you through the rest of your life.

Without benefits, health insurance will be an additional cost until the age of 65. Finally, only at the age of 62 will you become eligible to receive social security.

While money is important, it is not the only factor in deciding when to retire. If you are unhappy, suffering high stress, or developing health issues you should consider either changing your career or retiring.

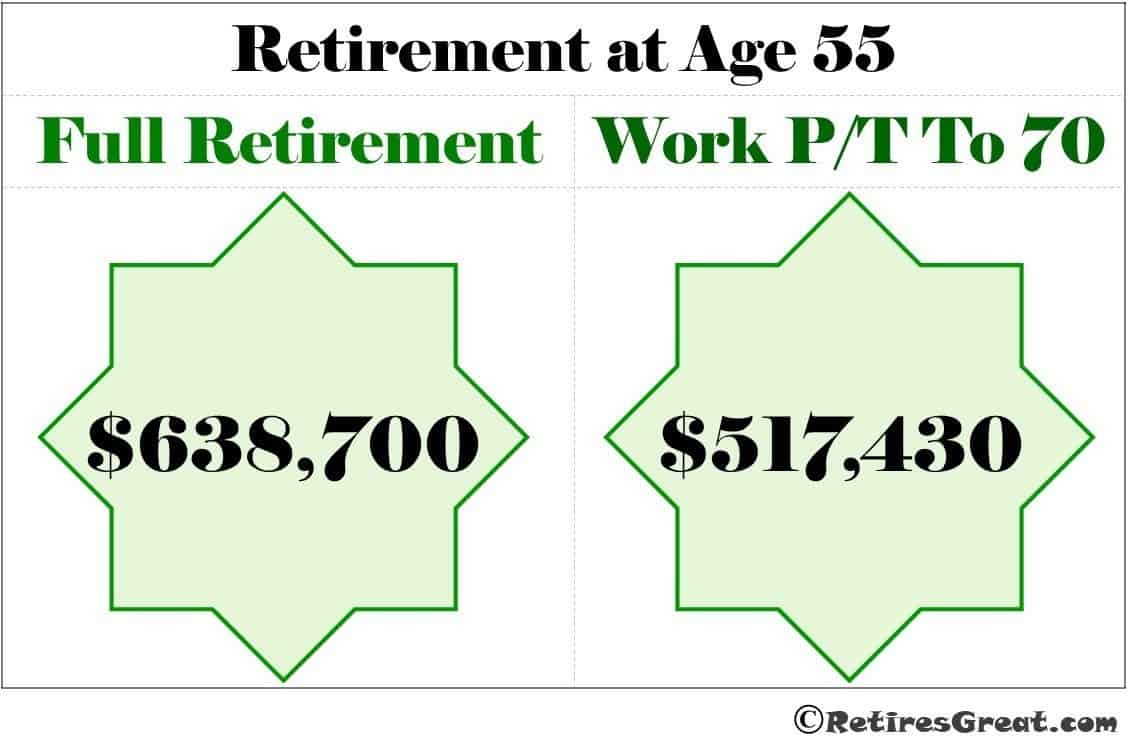

To fully retire at 55, the average couple should have saved $638,700. This is based on a life expectancy of 85, a yearly retirement income of $48,000, and investment interest return of 6%.

You might choose to work a part-time job. If you supplemented your income by $1,000.00 a month until age 70, their savings needed would be reduced to be $517,430.

From Article: How Much to Save for Retirement REALLY

62 - Most Common Age to Retire

If you google “most common age to retire”, you will find something similar to the screen shot below:

This information highlights that what age to retire varies tremendously and depends upon your unique situation.

How much to save for retirement delves deeper into the financial equations of what the average American really needs to retire based on retirement age.

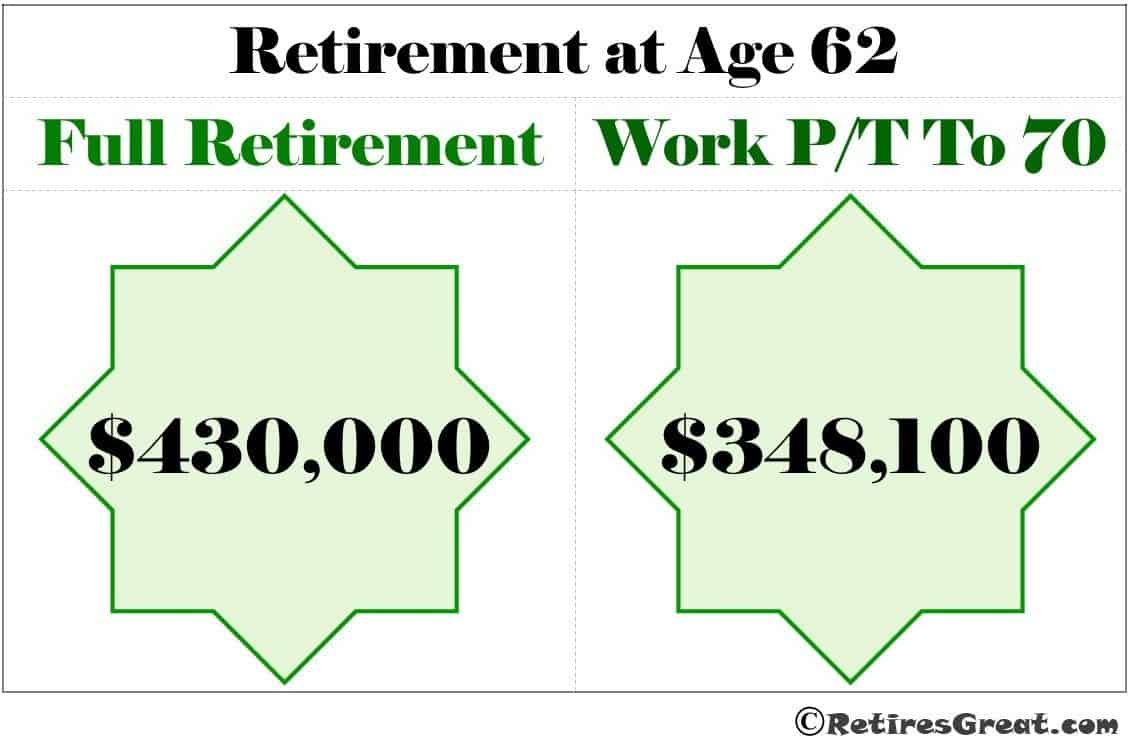

To comfortably retire at 62 requires saving $430,000. If you were to have a part-time job earning $1,000.00 per month until age 70, your savings needed would be reduced to be $348,100.

65 - Traditional Age of Retirement

At one time, 65 was the mandatory age of retirement. Legislation has changed this for most jobs, yet there are still strong social pressures that you should be retired.

By the age of 65, if you haven’t retired, you are likely contemplating retirement. Your financial situation has improved with all those extra years of work, increased social security payments, and Medicare coverage.

For a full retirement, your savings need to be $364,000. More importantly, you may be thinking of all those things you really want to do that you have never had time to do.

In addition, all those old aches and pains remind you that our time is finite.

Never Retire (or at least not until you have to)

You might be a career-oriented person that, quite simply, would be bored to death in retirement.

Retirement is not for everyone. In other instances, without sufficient retirement savings, continuing to work may be your only realistic option. In fact, almost a quarter of Americans plan to never retire!

Reasons you should never retire explores this growing trend. When you consider the skyrocketing healthcare costs, continuing increases in living expenses, and longer life expectancy, many of us may be at risk of outliving our savings.

Closing Thoughts

In conclusion, what age to retire is a personal decision totally dependent upon your current situation.