Did you know every day about 10,000 Americans turn 65 and are faced with enrolling into a program that can best be described as an unnecessarily complex range of options?

To address widespread confusion, our guide provides information on Medicare simplified enrollment.

According to Fidelity, as of 2019 the average 65-year-old American couple can expect to pay $285,000 throughout their retired years. Being an average, many retirees will spend considerably more without adequate health insurance.

And, this doesn’t include long-term care facilities, if required.

Besides being downright complicated, somehow, we need to gaze into a crystal ball and foresee future medical needs. An informed choice not only saves you money, it could very well extend your life.

Common Medicare Enrollment Mistakes

This might be one of the most important decisions that could haunt you for years to come. Delaying or making the wrong choices could cost you thousands of dollars or more. Further, it may impact your quality of care for the rest of your life.

Right off the bat, let’s get to the common mistakes on Medicare enrollment.

1. Missing the Initial Enrollment Period

You become eligible for Medicare upon your 65th birthday. Your initial enrollment period is seven months long. This includes the three months prior to your birthday, your birth month, and three months after.

If you miss this period, you may incur late enrollment penalties.

If you don’t register for Part B (medical insurance), the late enrollment charge is an increase of 10% in the monthly premium for each 12-month period delayed. This would remain for the rest of your life!

The exception to this is when you (or your spouse) are still working and covered under a group health plan through an employer. Under these situations, you may be eligible for a Special Enrollment Period (SEP).

2. Automatic Enrollment Without Fully Reviewing Your Options

You’ll be automatically enrolled into “Original Medicare” if you’re receiving Social Security benefits. This includes Part A (hospital insurance) and Part B (medical insurance). Unfortunately, this coverage only includes basic expenses.

There are many additional facets of health care expenses that should be considered. For instance, dental, vision and co-pays are not covered.

Once the initial enrollment period is over, adding additional insurance often results in penalties and much higher costs.

3. Opting Out of a Prescription Drug Plan

You might be as “healthy as a horse” and decide this is an unnecessary expense. The problem is later in life, prescriptions often become necessary. In this situation, it’s wise to have a plan affording some basic coverage.

If you already require prescription drugs, it’s imperative you have a plan that meets your needs. While that might sound obvious, many plans have restrictions or require substitution of generic medicines.

Even more critical, never let your coverage lapse!

4. Opting Out of a Medigap Supplemental Insurance

These are health insurance policies supplementing coverage of Original Medicare. They can cover some out-of-pocket costs, co-insurance, and other expenses.

There are a wide range of standardized packages to choose with premiums varying by providers.

What’s important to understand is they can’t deny coverage due to pre-existing conditions during your initial enrollment period. After that time, rates may go up considerably or coverage denied for a health issue.

5. Ignoring Medicare Advantage

At first glance, the monthly cost might seem higher. Especially if your primary concerns are Parts A & B. Yet, Advantage plans include a host of additional coverage that may very well save you money over the long term.

Most include prescription drugs, vision and dental coverage to name but a few. In addition, many have caps on co-pays and other out-of-pocket expenses.

Related article: 7 Ways to Reduce Healthcare Costs in Retirement

Additional Medicare Considerations

With rising healthcare costs and increased longevity, Medicare coverage becomes a critical decision. Several thoughts to consider include:

In short, how long do you expect to be around? Ironically, the longer we live, the more related healthcare expenses will be incurred.

Why is Medicare so Complicated?

First created in 1966, the US federal government created Medicare to provide a nation-wide health insurance for seniors. The program was implemented to address the growing issue of older citizens with no healthcare coverage.

Initially implemented by the Social Security Administration (SSA), it’s now administrated by the Centers for Medicare and Medicaid Services (CMS). The program has evolved to the point there’s a bewildering array of options.

Adding to the confusion are the multitude of private insurance companies either supplementing Original Medicare or replacing it altogether (Medicare Advantage).

There are four parts to Medicare referred to as Parts A, B, C and D. In addition, Medigap plans provide supplemental coverage through private insurers to fill any gaps.

All these options create confusion which is why it’s important to understand your needs and desired coverage. We wrote Medicare simplified enrollment in the hopes it would help with your choices.

The Difference Between Medicare and Medicaid

While both programs are administered by the same agency, CMS, Medicare is a federal insurance program for Americans 65 or older.

Medicaid is a federal and state plan intended to help low-income recipients.

Original Medicare (Parts A & B)

“Original Medicare” includes basic coverage for hospital and medical expenses, which are referred to as Parts A & B. These don’t cover all costs.

It’s estimated as much as half of medical expenses could be incurred in “out-of-pocket” costs for deductibles, co-pay and co-insurance.

Part A is often considered “free” to eligible Americans over the age of 65 as they pay no monthly premium. This is hospital insurance covering your stay for up to 60 days.

Your deductible (annual) will be $1,408. If you remain longer in the hospital, from the 61st to the 90th days, you’ll be charged $352 per day.

Part B covers doctor’s and medical fees for both in and outpatient treatment. The monthly premium depends upon your income. The average retiree pays $144.60 per month. The deductible is $198 with Medicare covering up to 80% of the costs.

Some examples of what’s covered includes:

Examples of what Original Medicare doesn’t include:

The out-of-pocket medical expenses can overwhelm the average person without adequate insurance.

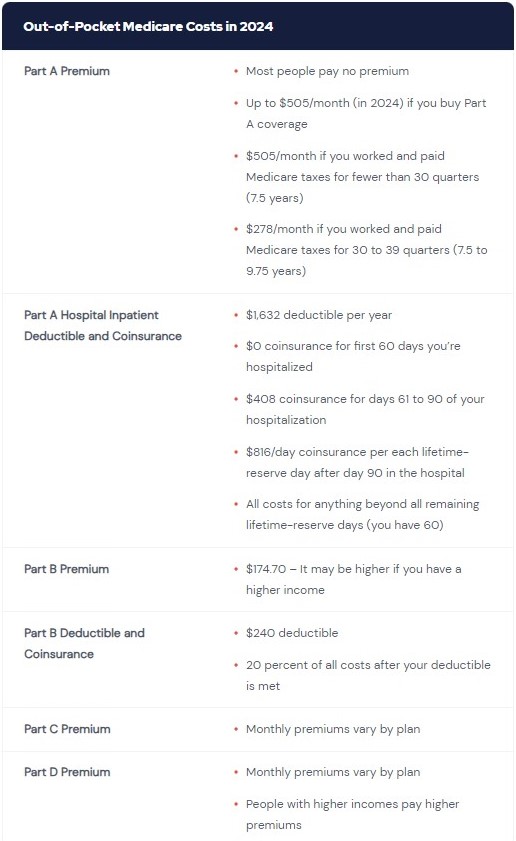

Cost of Original Medicare

Original Medicare doesn’t cover everything and there are deductibles, co-insurance and services not covered. Retire Guide’s table below summarizes some of these out of pocket costs.

To address these out-of-pocket costs, optional insurance programs such as Medicare Advantage or Part D (prescription drugs) and Medigap plans should be considered.

Another thing to keep in mind, your working income will generally be higher than what you receive in retirement. If you retire at 65, this could result in a higher monthly premium.

If this occurs to you, submit a claim with the Social Security Administration updating your retirement income.

Who Should Choose Medicare Original?

Keep in mind it’s only basic healthcare insurance and may only cover about half of your medical expenses. For those with good health, this may be a cost-effective option. For additional protection, Part D or Medigap are often added.

The reality is, as we age, the probability of health issues increases. For instance, a condition might develop requiring costly medications to manage.

In such a situation, the additional coverage not only provides peace of mind, it may also reduce costs.

Unfortunately, there are people who can’t afford additional coverage. Social security may be their primary source of income and they’ll need to deal with future medical expenses as best as they can.

Medicare Eligibility

There are several criteria to determine Medicare eligibility. These include:

Note: Individuals with certain medical conditions or disabilities may also qualify.

Medicare Simplified Enrollment

If you’re receiving Social Security benefits, enrollment into Parts A & B are done automatically when you turn 65. You’ll receive your card in the mail and the premium will be deducted from your benefit.

Alternatively, your options include:

The enrollment window extends three months before and after your 65th birthday. Even if you’re still working with employee sponsored benefits, it’s wise to contact them to avoid penalties.

In these situations, you’ll want to apply for the special enrollment period (SEP).

The penalty for late enrollment in Part B is a 10% increase in the monthly premium. For every 12-month period late, this penalty is applied increasing the premium the rest of your life!

Medicare Advantage (Part C)

In 1997, Advantage was introduced as an alternative to Original Medicare. In addition to including Parts A & B, it offers optional coverage for other medical expenses such as vision, dental, hearing and prescription drug plans.

Medicare Advantage is offered by private companies contracting through Medicare. There are numerous providers offering their customizable menus of options.

According to the AARP, changes have been made expanding the benefits. For instance, coverage for hearing aids are now an option.

Who Should Choose Medicare Advantage (Part C)?

There are several benefits of Medicare Advantage over the basic plan. Additional coverage can reduce overall health care costs and provide more comprehensive protection. Out-of-pocket costs can also be reduced.

Dealing with one insurance carrier is more convenient than dealing with multiple entities. Especially if you’ve been with a private insurer and prefer remaining with them.

There are also potential drawbacks which should be evaluated such as:

Enrollment

To be able to join a Medicare Advantage (MA) plan you have to meet three conditions:

Even if you have any pre-existing conditions (other than ESRD), you can enroll in Part C.

The most critical aspect is finding a plan and provider that meets your needs, both today and in the future. There are many companies offering insurance plans.

The difficulty lies in that, each year, providers can change their plans or even opt out of providing Medicare Advantage. There’s the risk you might be changing providers if this occurs.

You can only join, switch or drop a MA plan during the time period of October 15 – December 7. If you’re joining, your request must be received by December 7 for the coverage to begin on January 1.

There’s an open enrollment period between January 1 and March 31 each year. During this time, you can switch one MA plan for another if it better suits your needs.

If you’re finding this isn’t the best option for you, it can be dropped during this time. You’ll, then, return to Original Medicare (Parts A & B). You have the option of enrolling in a drug coverage program (Part D) as well.

Medicare Prescription Drug Coverage (Part D)

Part D is optional insurance for prescription drugs. No one can be denied access to this plan during the initial enrollment period. Also, no physical exam is required for acceptance.

These are available through approved private insurance companies, each charging a monthly premium. The appropriate plan will reduce out-of-pocket cost for your prescribed medicines.

Enrolling in Medicare Prescription Drug Coverage (Part D)

First, you need to take stock of your particular situation.

If your situation alters and you decide to enroll months or years later, a late enrollment penalty will be incurred. You’ll, most likely, be paying it for as long as you have this plan.

A KFF study found the price for Part D can range from as low as $12 to a high of $192 in 2020. Also, payments will vary based on earnings. If you have a higher household income, an adjustment will be made raising your premium cost.

Even with drug coverage, there might still be some sort of deductible or co-pay that you’ll be responsible for handling. When you’re comparing company plans, it’s important to have some criteria for making the best choice for you.

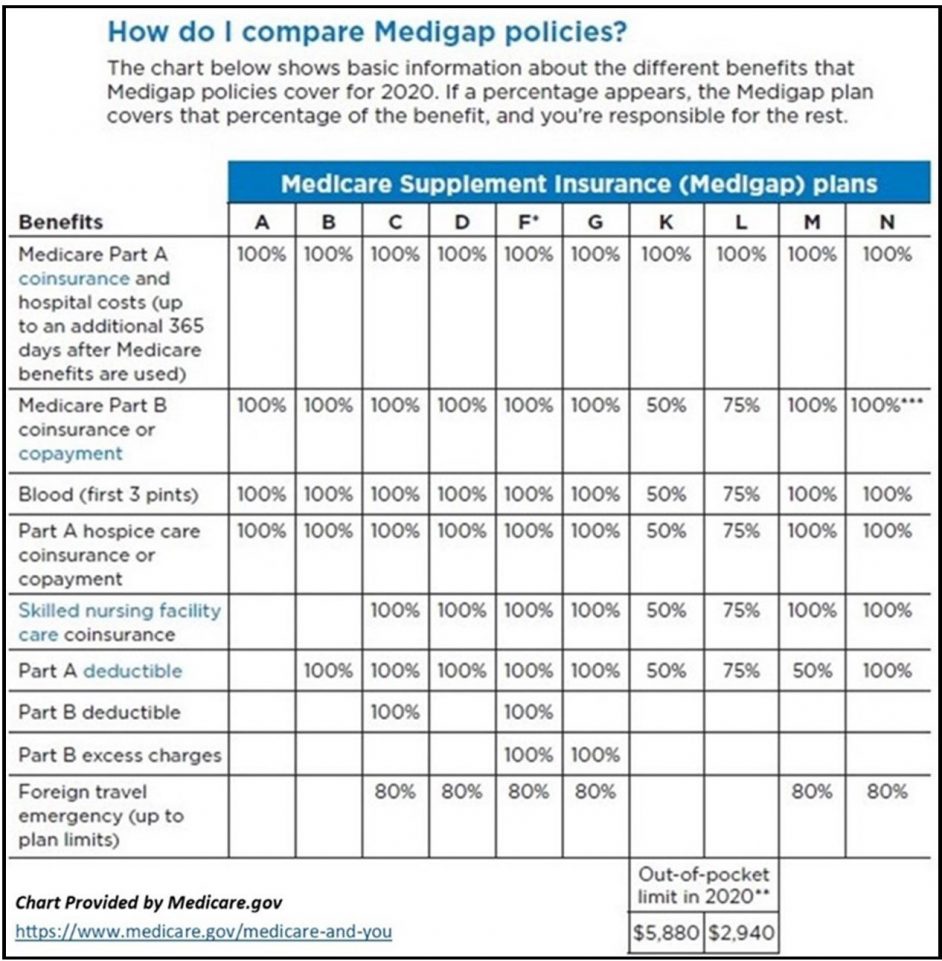

Medigap Plans

Medigap is optional insurance to fill in the gaps of Medicare Original. The policies provided by independent insurance companies augment your desired coverage.

They can also minimize out of pocket costs of co-payments, deductibles and co-insurance.

The various plans are standardized by the government. This makes them easier to compare and understand what you’re getting. The only real differences are their track record and how they price their policy.

It’s important to note that they don’t cover long term care, hearing aids, eyeglasses, vision or dental care or private duty nursing.

Enrollment

After receiving your Medicare card, you’re able to proceed with your chosen provider. Within six months of turning 65, you have guaranteed acceptance. After this time, the insurance company gains discretionary control.

Closing Thoughts on Medicare Simplified Enrollment

This guide is an overview of the complex health insurance system called Medicare. Our intent is to make it easier to understand your options.

Medical expenses are a major cost in retirement and it’s critical to carefully review enrollment. The wrong choices can cost you more in the long run and impact future health care.

For more detailed information, go to the Medicare.gov website which also has a downloadable 120-page guide.