Updated November 15, 2020

You probably never dreamed it would happen to you. Yet, countless thousands across the country every day deal with forced retirement.

The loss of employment at this critical stage can be financially devastating and emotionally crippling.

Recovering from job loss after the age of 50 will be the determining factor in how the rest of your life unfolds.

It happened to me and the words still sting “Today is your last day”. Consumed with disbelief and bitterness, the following days and weeks were a blur. A top performer with 25-years of loyal service, yet discarded one month before my 53rd birthday. In hindsight, these are the things I wish I had known back then.

How Common is Forced Retirement?

Flouting age discrimination legislation, IBM has laid off over 20,000 senior employees since 2013. And that is only the tip of the iceberg as companies continue to shed experienced employees.

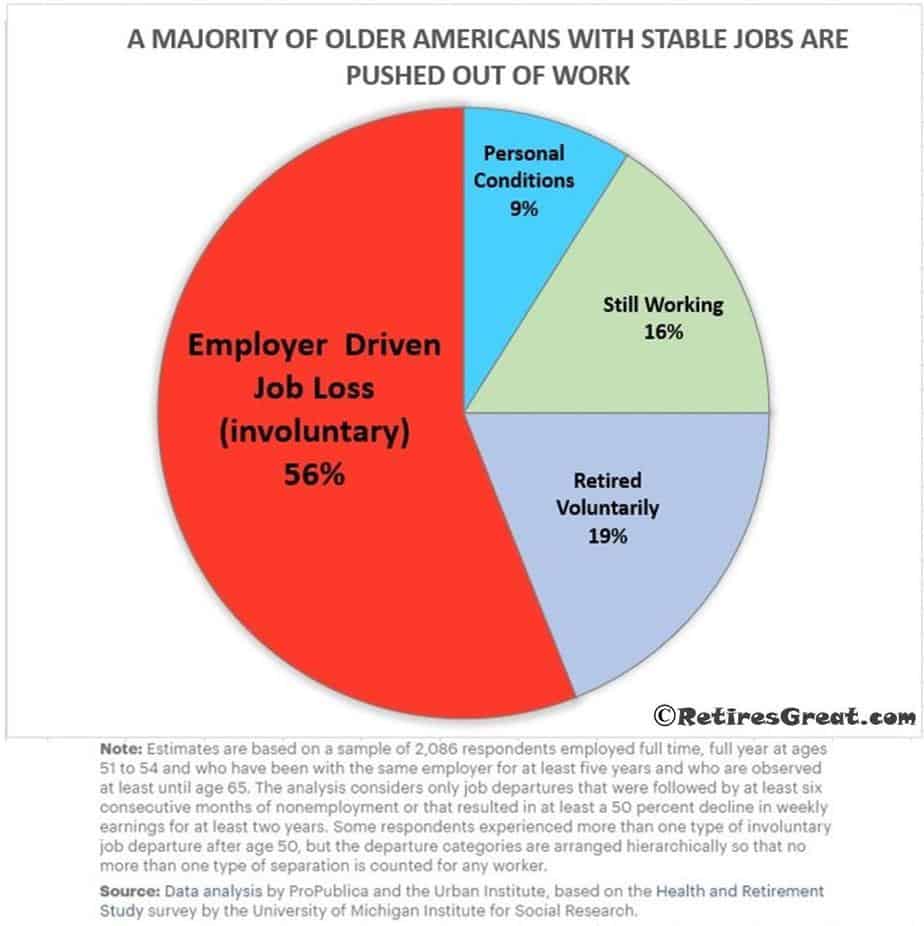

According to ProPublica and the Urban Institute, a majority of older Americans with stable jobs are pushed out of work.

Their analysis reveals that 56% of those over the age of 50 have experienced employer driven job loss. Effectively, they were forced out either through layoffs or deteriorating conditions.

The significance of the study is understanding the impact of ageism in the labor force. Although many will succeed in getting another job, it often takes months of job searching to find their next employer.

Only one in ten will ever again earn a comparable salary. Making matters even worse, a third of these people will experience losing their second or even third jobs due to their age.

What is Forced Retirement?

The difference between being forced and voluntarily retiring is, ultimately, who makes the decision. Thus, it’s the employer who forces the job loss and it’s not a free choice by the employee.

For instance, a buyout package may be offered to incent older employees to leave.

While this might sound voluntary, if you don’t accept you may later be forced out with little or nothing. Thus, you really have no choice but to leave.

Those final years of work are critical in padding your “nest egg”. It’s estimated 45% have not saved anything at all.

They’re dependent upon those final years and losing their jobs will impact the rest of their lives. Most will never financially recover and these people may never be able to afford to retire.

Why Do Companies Force Older Workers Out?

The cold hard fact is that older employees are more expensive. Compared to their younger counterparts, it’s proven that they earn larger salaries, have more vacation time, and the cost of benefits is higher.

Perceptions are that productivity diminishes with age as well as increased risk of health issues. Ultimately, it all comes down to bottom line profits so the die is cast.

Human resource departments are tasked with reducing employment costs. They probably have a spreadsheet identifying each and every employee over the age of 50.

In all fairness, there is validity to some of the above points. We all know someone who is counting down the days until they retire. Burnt out and jaded, they are effectively “retired at their desk”.

Instead of focusing on these employees, the mandate becomes pruning everyone past a certain age. This can further be justified with creating opportunities for the younger generation and fresh ideas.

How Do Companies Force Older Workers Out?

There are enlightened companies recognizing that some of their older workers are their most valuable asset.

They grasp the real value of these employees lies in the knowledge they have accumulated over the years, the relationships they have forged, and their commitment to the success of the organization.

This can’t be easily replaced by someone younger. As for the rest of the companies, they are going to find a way to get rid of you.

Because age discrimination is illegal, absolutely no one will ever admit to practicing it. Usually, it will be under the guise of tough economic times or the need to reduce costs.

Downsizing and layoffs generally focus on older staff. When they decide to outsource, it paves the way to shutting down entire departments and offices.

Other insidious practices include elimination of raises and bonuses. Opportunities for advancement or promotion become reserved for those younger.

You know you have a target on your back when they offer you a buy out package to voluntarily leave.

More aggressive tactics can include putting you on a performance plan, demotion to a lesser position, and even forcing relocation.

If you are in one of these situations, the “writing is on the wall” and your days are numbered.

Initial Steps When Dealing with a Forced Retirement

You’d think we would all see it coming and be better prepared. Yet, most of us are blindsided believing we are a valued employee and it won’t happen to us.

Somehow, over the years we convinced ourselves that our loyalty and hard work meant something to the company.

Then seemingly out of the blue, you’re terminated. OUCH! The suddenness and shock of it can feel paralyzing.

Even if you half expected this day, it is still going to be upsetting. This is highly personal because they just tossed you onto the scrap pile! It hurts you and your loved ones.

This is a life changing event that may impact the rest of your life.

Share Your Feelings, Don't Bottle Them Up

You may not even remember driving home (I know I didn’t). The healthiest way to deal with forced retirement is to share your feelings and what happened with your partner as soon as appropriate.

If you’re not in a relationship, speak with a close friend or family member. Make it clear you don’t want advice (at least not yet). It makes a big difference to talk about it rather than bottling it up.

Those First Few Days and/or Weeks

Expect your thoughts to be scattered and this to be an emotionally charged time. Your entire daily routine is dramatically changed.

Instead of getting up in the morning and rushing to work, you’re going to feel somewhat lost. Most people report missing the social interaction they had at work.

Try to get out of the house each day and meet a friend for coffee or lunch. Plan to accomplish something each day, even if it’s small.

What you don’t want to do is slide into a funk becoming consumed with bitterness. Give yourself permission to grieve and take as long as you need.

Some of the emotions you might wrestle with include:

Avoid making rash decisions or burning any bridges. Keep in mind you might need a good reference from your previous employer.

Having said that, if you were presented a severance package, at some point this needs to be reviewed. Get legal advice if you believe you were wrongfully dismissed.

What Are Your Options?

As the dust settles, it’s time to start thinking about what you want and your options. This is a crossroads in life and not a decision to be taken lightly.

Should you retire or do you need to replace your paycheck? Perhaps you received a buyout or are eligible for unemployment benefits.

How much will you get on unemployment discusses eligibility as well as maximum weeks/dollars. That buys you some time to better evaluate your options and decide what is best for you.

Maybe you’re only looking for a few more years of work until you can retire. Your skills and expertise are in demand and should land you a job reasonably quickly.

Others might consider further training to enhance their marketability. If you disliked what you did, it might be time to launch a new career doing something you enjoy or even starting a business.

Some people have no intention of retiring or, at least, anytime soon.

Should You Retire?

This is a highly personal decision that, for most people, comes down to age and finance. Almost everything you read seems to equate money with happiness.

We’ve all heard that money doesn’t buy happiness, yet living in poverty is not desirable. So, you’ll need enough income to support the lifestyle you desire.

Many people have decided they will never retire and Why You Should Never Retire provides more information.

After what you have been through, it can be difficult to find the motivation to start over again. You might feel worn-out and desire less stress in your life.

Also, finding a decent job becomes increasingly difficult after the age of 50. If you disliked what you did for a living, is that paycheck worth wasting more precious years of your life?

Health issues or a family history riddled with disease also weigh in on your decision. Some questions to ask yourself include:

A growing trend is retirees re-entering the labor force. One reason is out of financial need when they realize they will outlive their savings. For others, it comes down to boredom.

It appears they needed a year or two to recharge and, then, desire to do something more meaningful to them.

A final thought on deciding if you should retire. This is going to have a big impact on your partner and needs to be discussed.

Compromises need to be made as their thoughts on retirement likely differ from yours.

Finding New Employment After 50

While getting a good job has never been easy, it becomes increasingly difficult once you pass that half century mark.

Expect your job search will drag out for months and consider it a full-time job. Your confidence erodes and you begin to question, who would hire you?

A good employment agency can help you sharpen your job-hunting skills and position you with prospective employers.

Also, they can assist with matching skills with positions and may suggest additional training to find your perfect job.

In addition, they can guide you in working smarter using the most effective ways of marketing yourself to prospective employers.

Ageism

The unfortunate truth is that even though you are highly qualified, your application will often be screened because of your age. Common perceptions by some employers include that older applicants are:

Accept that these stereotypes are out there, particularly in some of the larger corporate entities. More progressive organizations recognize the value of their “seasoned” employees.

They value the expertise, work ethic, and loyalty often lacking with younger generations. They understand the importance of “soft skills” and relationships.

These tend to be smaller companies or those with customer bases consisting of an older population demographic.

Your Resume

We all know that your resume is critical, yet most are poorly written. It should be customized for each prospective employer conveying your unique value.

This means showcasing your accomplishments with measurable outcomes. For example, let’s say you were a manager with a dozen direct reports. Most resumes list duties and responsibilities.

Your resume becomes far more powerful when you provide an example of how you actually accomplished it.

Say you increased sales by 18% over a quarter, that might certainly elevate their interest in you. The purpose of your resume is to get short listed for an interview.

Networking, Networking, Networking

Frequently jobs are filled with no external advertising and it becomes who you know that matters most.

By enlisting family, friends, and acquaintances, you may learn of positions you would otherwise be unaware of.

Social media such as Facebook can also dramatically extend your reach. LinkedIn is a useful platform to update your profile and to research companies.

Posting an article on your field of expertise can generate exposure and enhance your credibility. Keep current by attending conferences and networking functions.

Starting a Business After 50

Not everyone wants to or should start a business. On average, entrepreneurs work longer hours earning less money than working for an employer.

The upside is that they are their own boss and there is no limit as to how much money they can make.

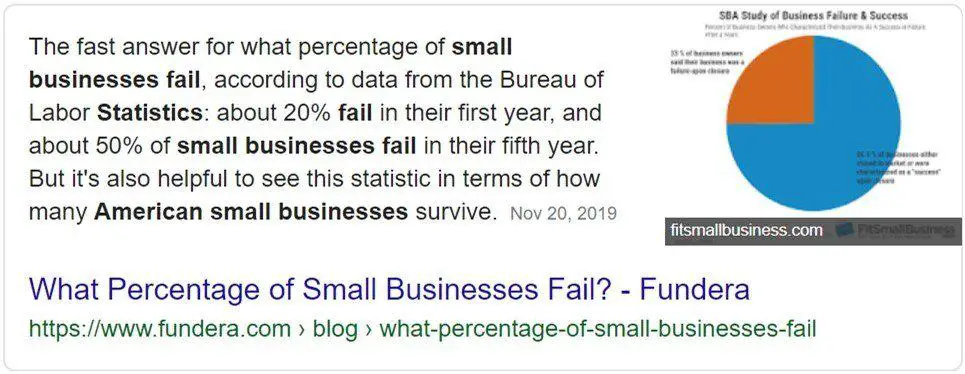

The downside is everything rests on your shoulders. Statistically, about 50% of small businesses fail within five years.

In spite of these dismal statistics, becoming your own boss may be the right decision for you. It’s not surprising to learn that the 55 to 64 age group represents the largest number of new businesses.

Also, they tend to have a higher success rate. This is largely due to gaining a lifetime of experience, the number of relationships they have developed, and better financial positions.

One might also argue these individuals are more focused and committed to doing whatever it takes to achieve success.

What Business to Start

The opportunities are almost limitless. The most successful businesses meet an unfulfilled need by offering a better product or service than otherwise available.

For example, you might decide to leverage your skills and experience as a contractor or on a consulting basis.

For organizations lacking in manpower or expertise, you become a perfect fit. Ironically, your previous employer might even be a candidate for your services.

Let’s say you’d rather launch something completely new. At a minimum, it should be something you are interested in and have (or can gain) expertise in.

Everyone looks for value for their dollar which is highly subjective to the person spending the money. Reducing costs may be the primary factor or they may be willing to pay more for a superior service.

As well, risk is important as people tend to buy from those they know, like, and trust. Some of the questions you want to address include:

For example, you might be passionate about fishing and desire to earn an income. Three options come to mind:

Closing Thoughts

How to deal with forced retirement addresses the financial and emotional challenges of recovering from job loss after the age of 50.

Your next steps will be critical in determining the quality of the rest of your life.