An intriguing trend is the number of boomers “unretiring” and going back to work. Rather than kicking back and enjoying retired life, they’ve decided to re-enter the workforce.

Getting a job you enjoy in retirement is easier today than ever before. The biggest challenge is deciding on the perfect job. Then, update your resume/skills, network, use an employment agency or online job search and prepare for the interviews.

For some, supplementing their income is the primary objective. Conversely, at this stage in life, doing something interesting and rewarding might take priority. In these situations, the paycheck becomes secondary.

Unlike their younger counterparts, older workers have a wealth of experience. And, in a tightening labor market, they can afford to be more selective.

Why It's Easier Getting a Job Than Every Before

On a macro level, the American population is aging. In fact, by 2030 the entire baby boomer generation will be 65 or older.

The pandemic and associated health concerns have hastened the number of older workers leaving as we discuss in the Great Retirement Exodus. The lingering effects of the pandemic continue to change the workplace landscape.

The leisure, travel, airlines and hospitality industries were devastated with massive layoffs. Non-essential businesses were shuttered for extended periods. Some never recovered and closed their doors forever.

Many companies cut deeply and ruthlessly with unemployment peaking at almost 15%!

Disproportionately affected were the young and older workers. Restaurants, bars and other non-essential businesses went through cycles of opening and closing.

Online business thrived as consumers switched to shopping on the internet. Working from home became the norm for many employees. Both trends are expected to persevere, further changing business forever.

By March of 2022, the American economy bounced back adding 431,000 jobs. The future looks bright with unemployment dropping to 3.6%. On the flip side, we’re also experiencing the highest inflation in the past forty years.

What Does This Mean for You?

For many years certain corporations have, not so subtly, encouraged their older workers to retire. It appears this strategy has backfired as they now realize some of their most experienced talent walked out the door.

In fact, many are unable to fill key positions. Even unskilled jobs remain open as younger workers have moved on seeking better and more stable career opportunities.

The decks have tilted, many retirees are contemplating “unretiring” or, at least, getting something on a part-time basis. With high inflation and an uncertain future, this isn’t a bad strategy.

Perhaps for the first time in history, the opportunities for older workers have never looked so promising.

No longer is it just about a paycheck, many desire more interesting and meaningful work. Benefits and work life balance, also, take higher priority.

1. Define Your Perfect Job

One of the most common mistakes is applying for a position simply because you have a shot at it and the pay is decent. Just because you’ve got loads of qualifications or industry expertise, you’re not necessarily restricted to such a narrow field.

For example, many of my former colleagues were “Account Managers” in the telecommunications industry. Each year the sales quotas increased with pressure mounting to do more with less. It wasn’t a fun work environment.

After jumping off the crazy train, they were faced with the question of what to do next?

What Do You Want?

The first step is deciding what you enjoy and would like to do. Perhaps, it’s within your field of expertise or something completely new and different. The opportunities are almost endless and some of your considerations should include:

Referring back to my former colleagues, I was pleasantly surprised to learn two of them were employed at the Apple Store. They absolutely love the laid-back environment, playing with the latest technology and helping out customers.

Another bonus was the flexibility of a 20-hour work week and taking time off whenever they wanted. In many respects, the perfect retirement job.

Determining what you want might be the most important step in getting a job you enjoy in retirement.

2. Upgrade Your Skills and Remain Current

Keeping current is absolutely vital if you expect to land a decent job.

The successful candidate is expected to hit the ground running without the need for extensive training. To remain marketable, you may need to upgrade your skills.

A common belief is the employer foots the bill when it comes to any courses or certifications. This is the norm throughout most of our working years. However, who’s responsibility is it when you’re no longer working?

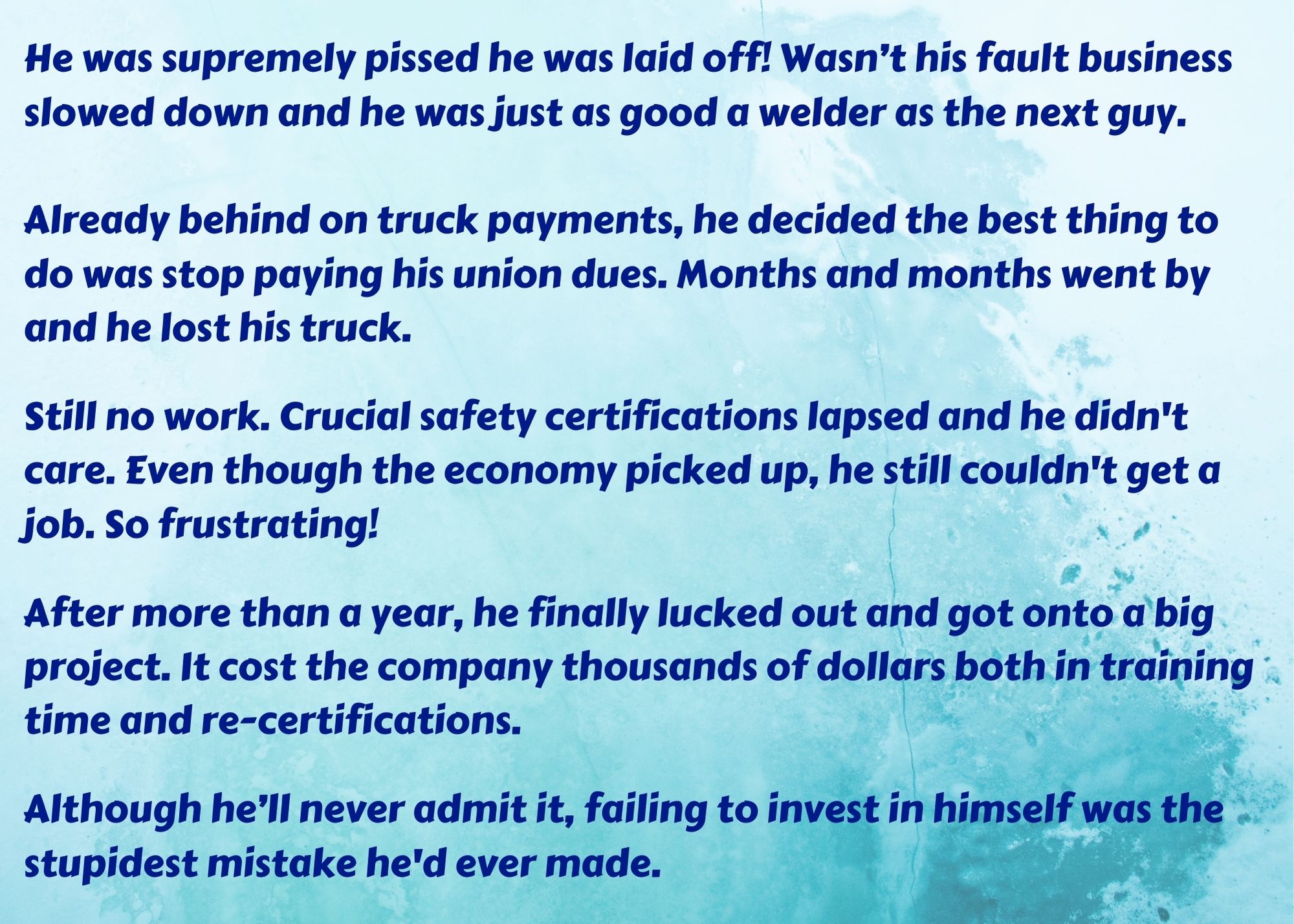

Even when unemployed, some folks refuse to invest in themselves. This brings to mind a real-life story from several years ago.

The moral of the story; if you’re unwilling to invest in yourself, don’t expect anyone else to.

What's Holding You Back from The Job You Want?

Say you’ve perused several job postings and find work from home positions appeal to you.

A standard prerequisite is, often, proficiency in Microsoft office. If it’s been a while since you used these programs, this might be a good time to take a few refresher courses.

Assuming you’re shortlisted, then, there’s a fairly good chance you’ll be interviewed via a video call. As much as everyone loves their smart phones, a more business-like approach is using a computer/laptop with video capabilities.

You’ll want some semblance of a home office and make sure you’re comfortable with the technology.

3. Engage An Employment Agency

For anyone seeking a professional position, signing up with an employment agency should be a no-brainer. Some of the benefits include:

The potential downside of an employment agency is getting “shoehorned” into specific roles. For instance, if your background is accounting, rest assured they’ll do their very best to find you an accounting job.

4. Update Your Resume

There are numerous resources and services on creating resumes, some free and others paid.

An example of a good resource is Quintessential Careers. Anyone feeling rusty or uncertain should check into these. Getting it right can pave the way to a job interview.

The standard means of screening job applicants is making three piles.

The “A” pile consists of those who appear most qualified and suited for the position. This means checking all the prerequisites such as education, work experience and technical skills.

In the “B” pile are the maybes where it’s not apparent if the candidate is a good fit. This isn’t the one you want to be in, although it’s marginally better than the third, which is a reject pile.

Retirees Resume Dos and Don'ts

There are countless tips and tricks to make a resume shine. However, the greatest challenge can be bouncing back after you’ve been retired for a few years. Specifically, are you still current?

5. Expand Your Network

An estimated 80% of jobs are never advertised online. The plain truth is no one wants to sift through hundreds of resumes. Not only is it extremely labor intensive, the majority of respondents aren’t qualified anyways!

Instead, these positions are usually internally posted or an employment agency contacted. This makes the hiring manager’s job much easier as the selection is pared down to more qualified individuals.

Furthermore, often, who you know is more important than what you know. Hiring the wrong person can be expensive and time consuming. Personal referrals and a sense of trust play a big part in the selection process.

How To Network More Effectively

Hands down, the top professional networking platform is LinkedIn. Not only is it completely free, without a profile you might be shooting yourself in the foot. Essentially, it’s a source of credibility to a potential employer.

In addition, it’s a great way to reconnect with former co-workers and bosses. Think of all the people you’ve worked with over the years and had a personal connection. This could include suppliers and even customers.

You might be surprised at the support you’ll receive. Besides expanding your network, other benefits can include:

Another networking strategy is joining your local Chamber of Commerce or other service group. The more exposure you create within the community, the greater the chance you’ll hear of what could be the perfect opportunity.

6. Prepare For the Job Interview

The job interview process will vary widely depending on the position and the company. For instance, applying to be a shuttle driver will likely focus on your driving record and social skills.

More professional and highly paid positions will generally be more formal and extensive. Having several interviewers present can feel downright intimidating. To deal with this, plan thoroughly and understand it’s also a two-way street.

To interview well, prepare for the most common questions and become comfortable with the process. There’re plenty of resources available online and, to practice, you could role play with a friend or family member.

Also, getting a job you enjoy in retirement requires you to determine if the company culture is a good fit for you. You owe it to yourself to ensure you’re comfortable and there are no personality clashes.

Yikes!...The Job Interview

Unlike employment interviews in your younger days, now you’re somewhat older and wiser. Recognizing ageism exists; how do you counter it? To be blunt, the person sitting across the table from you may have many unspoken reservations.

Privacy and discrimination laws prohibit certain questions, particularly when related to age or health matters. For this reason, your physical appearance and how you express yourself will be very carefully observed.

First impressions will be made which could be based on:

Stereotypes of older workers include they’re not tech savvy, fixed in their ways and have declining productivity. In addition, reporting to a younger boss can be problematic. If any of these arise, you’ll want to address them head on.

As far as the interview process goes, expect them to be curious why you’re coming out of retirement. Whether they ask or not, they’ll likely also wonder how long you plan on staying.

7. Consider Online Job Sites

The popularity of online job search websites has exploded, especially with the tightening labor market. Not all organizations want to pay the cost of recruitment agencies and these sites provide another source of job postings and resumes.

In this regard, they’re an alternative to the agencies. Several specialize in mature workers, a previously untapped market as more and more organizations recognize the value of experience.

Besides an expansive listing of targeted employment opportunities; you can post your resume online on some of these. Many also offer additional job search support.

Some of the online job sites you might be interested in include:

Closing Thoughts on Getting a Job You Enjoy in Retirement

I never dreamed I’d see the day when retirees are being sought after to rejoin the work force.

For years, older workers were targeted and even incented to leave. The pandemic accelerated this trend with companies slashing payrolls, small businesses going under and entire industries decimated.

The health risk also played a significant role. Many questioned whether their job was worth dying over. This might partially explain the dire shortage of teachers and nurses.

As the economy recovers, companies are scrambling to fill vacant positions. Many job postings remain unfilled due to the lack of qualified candidates. For anyone considering “unretiring”, there’s never been a better time.

Expectations have changed, in fact, everything’s changed! Companies are being forced to become more flexible, offering work from home options and other enticements. Work life balance has become a greater consideration than just pay.